Australian Dollar Analysis and Talking Points

- AUD/USD | Hitting 11 Year Low as Dollar Surges

- Australian Unemployment Rate Key to RBA Outlook

- Australian Dollar Outlook Remains Weak

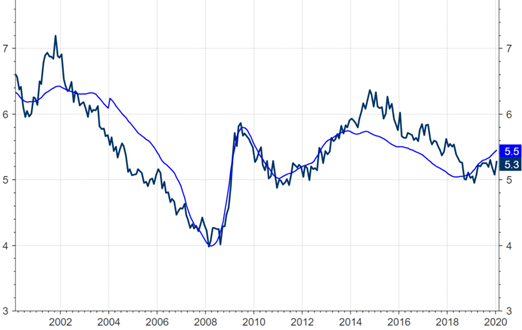

AUD/USD | The Australian Dollar has remained under pressure amid the rising concerns over the spread of the Coronavirus, while domestic data has also softened, most notably, the labour market report. As such, the currency is trading at an 11-year low against the dominant greenback Throughout the week, the latest employment data showed that the unemployment rate edged higher to 5.3%, above the expected 5.2%. Although, while this keeps the door open to further easing from the RBA, given that Governor Lowe stated that the unemployment rate needs to move materially higher, it would take another soft labour report to force the central banks hand. That said, we feel that near-term easing prospects will keep the Aussie contained with unemployment indicators signalling further deterioration.

| Change in | Longs | Shorts | OI |

| Daily | 3% | 19% | 7% |

| Weekly | 10% | -8% | 5% |

Australian Labour Market to Continue Softening

On the technical front, the outlook remains bearish for the Australian Dollar with upticks likely to be brief and shallow. Yesterday saw AUD/USD make a firm break below support at 0.6660-70, in turn with pair now trading below 0.6600, eyes are for a test of support situated at 0.6550. On the upside, prior support at 0.6660, is now likely to curb gains, while resistance is also situated at 0.6730.

AUD/USD Vanilla Options: 0.6670-80 (641mln)

Implied Weekly range (0.6524–0.6662)

|

Support |

Resistance |

||

|

0.6550 |

– |

0.6660-70 |

Prior Support |

|

0.6500 |

– |

0.6730 |

Weekly High |

|

0.6288 |

Mar’09 Low |

0.6750 |

– |

AUD/USD Price Chart: Daily Time Frame

Source: IG Charts

— Written by Justin McQueen, Market Analyst

Follow Justin on Twitter @JMcQueenFX