Central Bank Watch Overview:

- More weakness in Eurozone economic data coupled with a surge in COVID-19 cases has seen ECB interest rate cut expectations pulled forward, and the odds of surprise action at the October meeting are non-zero.

- It’s still the case that neither the Bank of England nor the Federal Reserve are expected to shift policy in 2020; the Fed is grappling with the US election cycle; the BOE is awaiting Brexit.

- Retail trader positioningsuggests that the US Dollar has a mixed trading bias.

European Central Bank Rate Cut Odds Pulling Forward

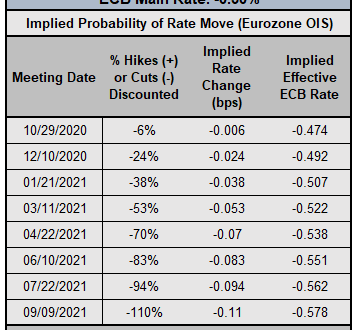

Eurozone economic data has been on a downward trajectory, and now that COVID-19 cases are surging once more, there’s a non-zero chance that the European Central Bank acts sooner than what interest rate markets are currently implying. While the late-summer jump in European Central Bank interest rate expectations has held, insofar as an interest rate cut deeper into negative territory will arrive sooner in the first half of 2021, it’s difficult to ignore the pandemic’s rolling impact.

EUROPEAN CENTRAL BANK INTEREST RATE EXPECTATIONS (OCTOBER 28, 2020) (TABLE 1)

According to Eurozone overnight index swaps, there is just a 6% chance of a 10-bps rate cut at the October policy meeting and still just a 24% chance of a 10-bps interest rate cut by the end of 2020. Interest rate cut odds have been pulled forward in recent weeks; in mid-September, there was just under a 15% chance of a 10-bps cut before the end of the year. March 2021 is now favored for the move, according to rates markets, with an implied probability of 53%.

IG Client Sentiment Index: EUR/USD Rate Forecast (OCTOBER 28, 2020) (Chart 1)

EUR/USD: Retail trader data shows 36.75% of traders are net-long with the ratio of traders short to long at 1.72 to 1. The number of traders net-long is 12.23% higher than yesterday and 16.15% higher from last week, while the number of traders net-short is 15.74% lower than yesterday and 21.33% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse lower despite the fact traders remain net-short.

Recommended by Christopher Vecchio, CFA

Get Your Free EUR Forecast

Federal Reserve Content with Standing Pat for Now

It still holds that little has changed with respect to the Federal Reserve, having enacted emergency interest rate cut measures and a slew of balance sheet-expanding operations. To this end, interest rate markets are still stuck in a state of suspended animation. Should the Fed change course, it will likely shift to via more QE, a repo facility, Municipal Liquidity Facility, etc.

FEDERAL RESERVE INTEREST RATE EXPECTATIONS (OCTOBER 28, 2020) (Table 2)

Seeing as how there’s been no indication thus far that the Fed will cut interest rates into negative territory,we’ve reached the lower bound for the time being. In the future, if yield curve control is implemented, we would expect a similar outcome to what is being experienced by the Reserve Bank of Australia main rate expectations curve, especially now that the Fed has extended its promise to keep rates low through 2023.

IG Client Sentiment Index: Dow Jones (CFD: Wall Street) Forecast (October 28, 2020) (Chart 2)

Wall Street: Retail trader data shows 53.86% of traders are net-long with the ratio of traders long to short at 1.17 to 1. The number of traders net-long is 4.64% higher than yesterday and 45.46% higher from last week, while the number of traders net-short is 1.49% lower than yesterday and 19.87% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests Wall Street prices may continue to fall.

Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger Wall Street-bearish contrarian trading bias.

Recommended by Christopher Vecchio, CFA

Get Your Free USD Forecast

Bank of England Rate Cut Odds Hone in on August 2021

The self-imposed Brexit deadline of October 15 on behalf of UK Prime Minister Boris Johnson has come and gone, but there is hope for a deal to come together by mid-November. It still holds that “asymmetric risk exists on the near-term horizon: volatility likely arrives in the unlikely situation that no deal is achieved; in turn, BOE rate cut odds are likely to either stay where they are or pull forward in the coming weeks, particularly as BOE policymakers discuss the prospect of negative interest rates more frequently and publicly.”

Bank of England Interest Rate Expectations (OCTOBER 28, 2020) (Table 3)

It still holds that speculation surrounding negative interest rates remains premature at best, insofar as rates markets don’t foresee that kind of possibility from becoming reality until at least August 2021. An EU-UK trade agreement would further reduce the likelihood of a shift into negative interest rate territory by the BOE; the current course would likely stick for a few years, akin to the Federal Reserve.

IG Client Sentiment Index: GBP/USD Rate Forecast (OCTOBER 28, 2020) (Chart 3)

GBP/USD: Retail trader data shows 50.50% of traders are net-long with the ratio of traders long to short at 1.02 to 1. The number of traders net-long is 8.51% lower than yesterday and 23.96% higher from last week, while the number of traders net-short is 6.49% lower than yesterday and 27.78% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.

Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed GBP/USD trading bias.

Recommended by Christopher Vecchio, CFA

Get Your Free GBP Forecast

— Written by Christopher Vecchio, CFA, Senior Currency Strategist