Crude Oil Price Forecast Talking Points:

- Crude oil price action has spent most of the past month in a range-bound formation.

- A bearish trendline came into play this week but, sellers weren’t able to make much of a mark and that range has held. Is a break nearby?

- DailyFX Forecasts are published on a variety of markets such as Gold, the US Dollar or the Euro and are available from the DailyFX Trading Guides page. If you’re looking to improve your trading approach, check out Traits of Successful Traders. And if you’re looking for an introductory primer to the Forex market, check out our New to FX Guide.

Crude Oil Builds into Range After a Trendy Nine-Month Stretch

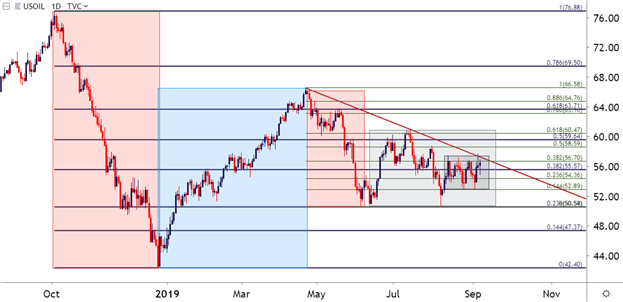

After an aggressive nine-month outlay of trends in both directions, WTI crude oil prices have recently built in a range formation that’s held since early-August. Last year’s Q4 sell-off, on the back of a strong run of risk aversion, pushed WTI all the way down to the 42.50 level that’s helped to hold the lows for the past three years; but a stark change-of-pace developed around the 2019 open that saw Oil prices claw back 70% of that prior sell-off.

But in late-April, bears came back and took control for the next six weeks, bringing prices back down to the 50.00 level.

WTI Crude Oil Daily Price Chart

Chart prepared by James Stanley; Crude Oil on Tradingview

That level around the 50-handle has now held support on two separate occasions in 2019, first in June and then again in early-August. The third test at that level may not be as supportive but, for now, prices are caught in an even tighter range that’s developed over the past few weeks, which has been governed fairly well by a Fibonacci retracement produced by the April-June sell-off. Resistance has remained around the 38.2% retracement while support has held around the 14.4% marker.

This week’s resistance got an assist from a bearish trend-line produced by connecting swing-highs in April and July, highlight an area of confluent resistance that continued to hold the near-term highs in wti crude oil prices.

WTI Crude Oil Four-Hour Price Chart

Chart prepared by James Stanley; Crude Oil on Tradingview

WTI Crude Oil Technical Forecast: Bearish

For next week the technical forecast for crude oil will be set to bearish. Initially, the short-side of the range appears as attractive, looking for a hold of this confluent resistance to bring on another test of the 53-handle.

More interesting, however, is the potential for the third test of that level to yield to a third test of the longer-term support around the 50-handle, specifically around 50.50.

Should that come into play, a bigger-picture scenario becomes of interest, looking for a longer-term re-test of the three-year-lows that show around the 42.50 psychological level, the same zone that helped to arrest the Q4 decline ahead of the Q1 ramp.

WTI Crude Oil Weekly Price Chart

Chart prepared by James Stanley; Crude Oil on Tradingview

To read more:

Are you looking for longer-term analysis on the U.S. Dollar? Our DailyFX Forecasts have a section for each major currency, and we also offer a plethora of resources on Gold or USD-pairs such as EUR/USD, GBP/USD, USD/JPY, AUD/USD. Traders can also stay up with near-term positioning via our IG Client Sentiment Indicator.

Forex Trading Resources

DailyFX offers an abundance of tools, indicators and resources to help traders. For those looking for trading ideas, our IG Client Sentiment shows the positioning of retail traders with actual live trades and positions. Our trading guides bring our DailyFX Quarterly Forecasts and our Top Trading Opportunities; and our real-time news feed has intra-day interactions from the DailyFX team. And if you’re looking for real-time analysis, our DailyFX Webinars offer numerous sessions each week in which you can see how and why we’re looking at what we’re looking at.

If you’re looking for educational information, our New to FX guide is there to help new(er) traders while our Traits of Successful Traders research is built to help sharpen the skill set by focusing on risk and trade management.

— Written by James Stanley, Strategist for DailyFX.com

Contact and follow James on Twitter: @JStanleyFX