Dow Jones Price Outlook:

Dow Jones Bulls Hold to Dovish Hopes Ahead of Fed Meeting

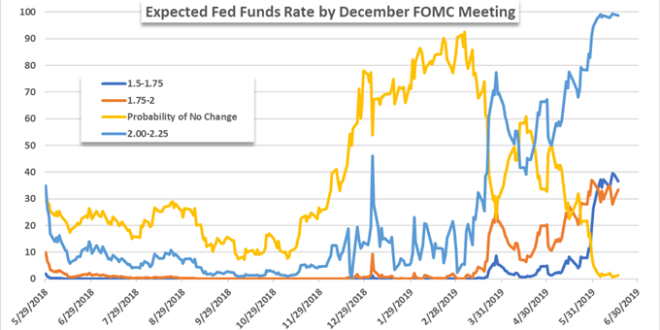

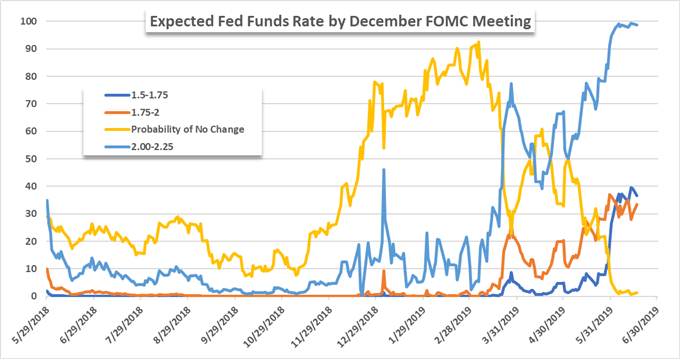

The Dow Jones approached Monday’s close marginally higher as traders look to position ahead of Wednesday’s Fed meeting. With deteriorating economic data, waning global growth and the persistent threat of trade wars, the expectations for a cut to the Federal Funds rate by year-end have soared. The Industrial Average will cling to these hopes for trend continuation purposes.

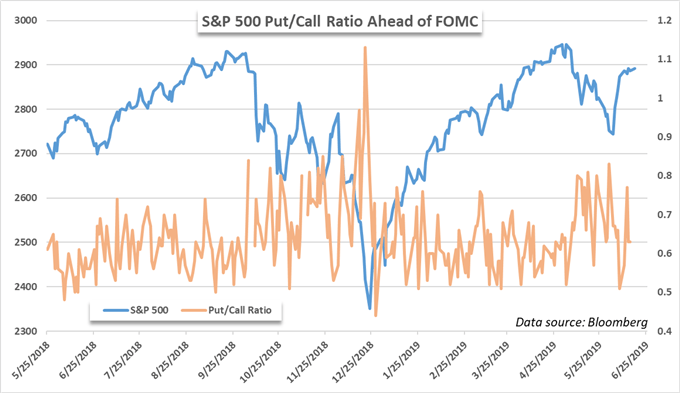

That said, there is the risk that market expectations will overshoot the central bank’s actual view of the economy and the evidence for a reduction in the Fed funds rate. Fortunately for bulls, the put-to-call ratio of the S&P 500 remains comfortably at the 1-year average of 0.63. However, retail traders are less convinced – or perhaps unaware of the expectations – and remain net-short the Index.

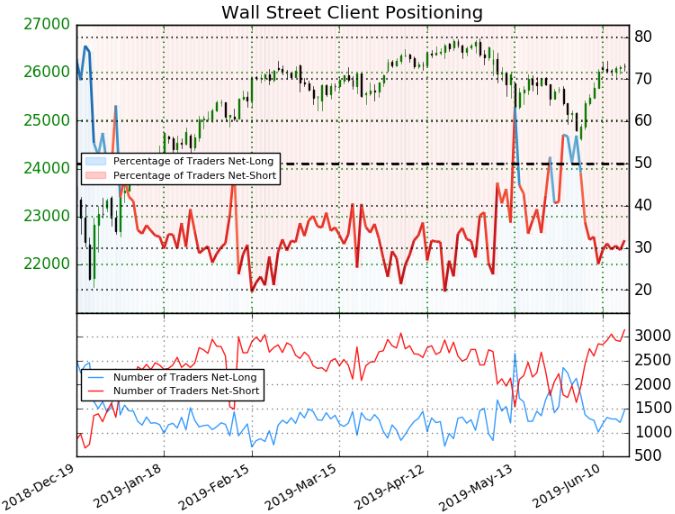

Retail trader data shows 31.8% of traders are net-long with the ratio of traders short to long at 2.14 to 1. In fact, traders have remained net-short since June 3 when the Dow Jones traded near 24880.6; price has moved 5.0% higher since then. The number of traders net-long is 3.0% higher than yesterday and 2.5% lower from last week, while the number of traders net-short is 0.1% higher than yesterday and 12.6% higher from last week.

We typically take a contrarian view to crowd sentiment at DailyFX, and the fact traders are net-short suggests Wall Street prices may continue to rise. Positioning is less net-short than yesterday but more net-short from last week. With a bullish signal from retail trader data and dovish expectations soaring, the Industrial Average looks primed to continue its June recovery which could see it test May highs around 26,700.

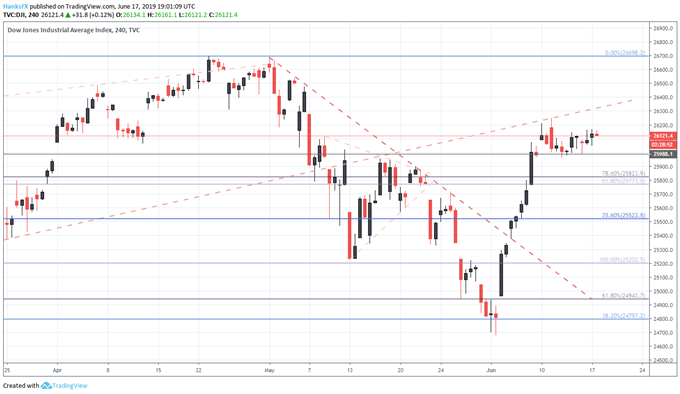

Dow Jones Price Chart: 4 – Hour Time Frame (February – June)

Should the dovish expectations come to fruition, the Average must first surmount the ascending trendline from February – now around 26,300 – before it can test 26,700. On the other hand, immediate support resides around 25,880 to 25,900 which kept the Index afloat throughout last week.

Quantitative Easing (QE) Explained: Central Bank Tool for Growth

As the anticipation for Wednesday’s Fed meeting builds, the Dow Jones may continue to melt up. That said, volatility will likely remain muted until the meeting and implications on monetary policy unfold. For a post-FOMC breakdown and technical updates on the Dow Jones, follow @PeterHanksFX on Twitter.

–Written by Peter Hanks, Junior Analyst for DailyFX.com

Contact and follow Peter on Twitter @PeterHanksFX

Read more:AUDUSD & Nasdaq 100 Price Outlook: Huawei Offers Opportunity