Euro, US Dollar EUR/USD, CPI, Retail Sales, Durable Goods – Talking Points

- Euro may fall on Eurozone CPI and retail sales data

- US Dollar may suffer from soft durable goods orders

- EUR/USD technical analysis: what to look for ahead

The Euro may fall against the US Dollar if preliminary CPI data shows weakening price growth, potentially undoing some of EUR/USD’s recent gains. However, the pair may be able to trim some of its losses if US durable goods order spark a larger selloff in the Greenback than the Euro. Eurozone retail sales will also warrant close scrutiny.

Preliminary year-on-year core CPI – excluding food, energy alcohol and tobacco – for December is expected to remain unchanged at 1.3 percent. However, the month-on-month report for the same time period including volatile inputs is expected to grow 0.3 percent, up from the prior -0.3 percent contraction. Retail sales on an annual and monthly basis are expected to grow 1.5 percent and 0.7 percent, respectively.

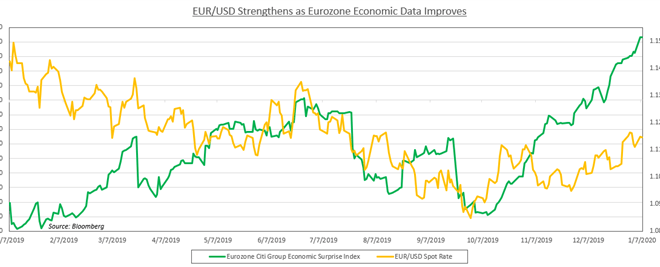

According to the Citi Group Economic Surprise Index, Eurozone data has been gradually improving since early October, and has recently begun to outperform economists’ expectations amid fundamental stabilization. Not entirely by coincidence, the EUR/USD exchange rate has strengthened amid a market-wide selloff in the US Dollar from fading demand for haven-linked assets.

The respite in Brexit uncertainty may also help boost the continent’s economic growth, though that may change as EU and UK discuss future trading relations. There is also the issue about EU-US trade relations which, for now are on the backburner but may very well become a headline issue if tension escalate. Auto tariffs are still on the table and the US has other tools in its economic arsenal it can weaponize against the EU.

EUR/USD Technical Analysis

Since bottoming out in on November 29, 2019, EUR/USD has risen just under two percent and briefly touched multi-month highs before retreating. The pair continues to climb along the November uptrend, though bulls may wait to commit capital until EUR/USD bounces back from rising support. Conversely, a break below it with follow-through could precipitate a selloff with an eye at the 1.1063-1.1075 support range.

EUR/USD – Daily Chart

EUR/USD chart created using TradingView

EURO TRADING RESOURCES

— Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or @ZabelinDimitrion Twitter