EUR/USD Price, News and Analysis:

BUILDING_CONFIDENCE-IN_TRADING

EUR/USD Trades Heavy with Little Positive Sentiment Around

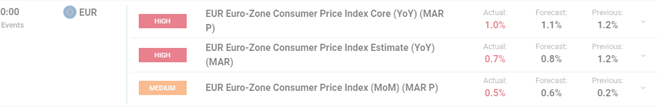

Inflation in the Eurozone is slipping lower with the provisional core CPI reading for March released at 1.0%, below expectations of 1.1% and a prior month’s 1.2%. While inflation may not be on the top of the ECB’s ‘to fix’ list, when the coronavirus situation steadies and is eventually cured, the central bank will need to look at how to resolve the underlying weakness in inflation.

Earlier in the session, German unemployment change (March) came in better than expected – 1k vs. 25k – although the figures only cover up to March 12 and do not show the full effect of the coronavirus shutdown.

The daily EUR/USD is now starting to look weaker with the pair over 150 pips off Monday’s high print at 1.1145. EUR/USD is currently trading below all three moving averages, and opened below the 200-dma, casting a negative shadow on the pair. A short-term Fibonacci set-up on the March 9 to March 22 sharp sell-off shows the important 38.2% retracement level very close at 1.09645. If this breached and closed below then further losses may be seen with a zone between 1.0875 and1.0895 the first level of support. The upside looks capped in the short-term between 1.1055 and 1.1066 – 200-dmaand 50% Fibonacci retracement.

For all market moving data and events please the DailyFX calendar

EUR/USD Daily Price Chart (October 2019 – March 31, 2020)

| Change in | Longs | Shorts | OI |

| Daily | -2% | 25% | 14% |

| Weekly | -23% | 84% | 21% |

What is your view on EURUSD – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.