Gold Fundamental Outlook: Neutral

- Will gold prices continue range-bound price action next?

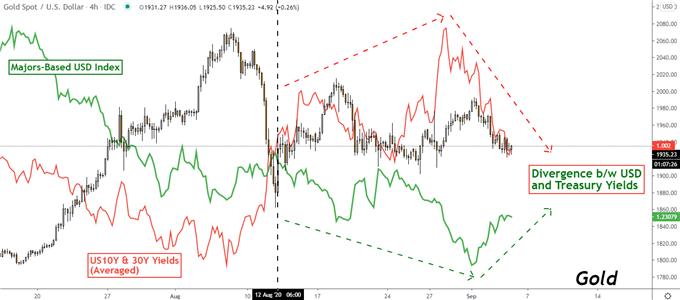

- Diverging Treasury yields and US Dollar in focus ahead

- What can be a potential downside risk for XAU/USD?

Gold prices may remain range bound in the week ahead as the precious metal contends with competing fundamental forces. On the whole, XAU/USD has struggled to make meaningful headway since prices collapsed in early August. This represented a shift away from what was the bullish trend in play since March.

Recommended by Daniel Dubrovsky

What is the outlook for gold this quarter?

Market volatility picked up pace this past week as the S&P 500 declined and the VIX ‘fear gauge’ soared. This followed rather disappointing US ISM Services PMI data, pointing to perhaps a tougher road ahead for the largest component of the US economy. As a result, longer-dated Treasury yields, such as the 10-year and 30-year, declined on rising demand. Meanwhile, the haven-linked US Dollar gained ground.

XAU/USD often behaves as an anti-fiat hedge. The precious metal yields no return for holding the asset and can be sensitive to inflation expectations. In global financial markets, gold is also widely priced in the US Dollar, making it sensitive to the currency’s fluctuations. Thus, when both the US Dollar and Treasury yields move in the same direction, this combination can have a profound impact on prices.

Recommended by Daniel Dubrovsky

Don’t give into despair, make a game plan

Since the middle of August, Treasury yields and the US Dollar have tended to move in opposite directions – see chart below. With that in mind, it is not necessarily surprising to see gold consolidate over the same period. After gains in Treasury yields throughout most of August, these still have some room to give, offering a cushion to gold in the event that aggressive risk aversion boosts the US Dollar.

The Citi Economic Surprise Index tracking US data recently fell to its lowest since early July. That suggests economists’ expectations are slowly aligning closer towards reality, and rosy outcomes could become more infrequent. For the precious metal, the risk remains that a pickup in volatility puts a premium on liquidity and thereby on USD, much like in March. But, a relatively quiet US economic calendar docket could keep prices ranging.

For updates on gold including technical levels, be sure to follow me on Twitter @ddubrovskyFX.

Gold Fundamental Drivers – 4-Hour Chart

Gold Chart Created in TradingView

*Majors-based USD index averages it against: EUR, JPY, GBP and AUD

— Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter