Gold took out the 2014 high ($1392) after the Federal Reserve altered the forward guidance for monetary policy, and the price for bullion may continue to benefit from the current environment as the central bank appears to be on track to switch gears over the coming months.

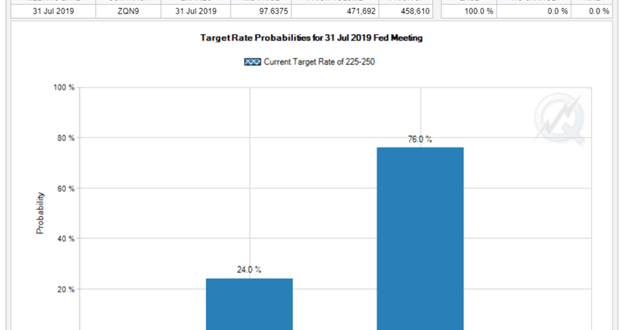

July Fed Meeting Interest Rate Probabilities

In fact, Fed Fund futures now highlight 100% probability for at least a 25bp rate cut at the next rate decision on July 31. The central bank may show a greater willingness to establish a rate easing cycle as the dot-plot shows the benchmark interest rate narrowing to 1.75% to 2.00% by the end of 2019.

To read the full Gold Price Forecast, download the free guide from the DailyFX Trading Guides page

Gold Price Technical Analysis: Look to Fade Weakness into Q3

Gold prices are testing big resistance into the final week of June trade and while the broader focus is higher in XAU/USD, look for a larger pullback early next quarter to offer more favorable entries while above 1319. Ultimately, we’re targeting fresh yearly highs above 1400 in the second quarter before a larger correction.

To read the full Gold Price Forecast, download the free guide from the DailyFX Trading Guides page

Gold Price Weekly Chart

Chart prepared by Michael Boutros

To read the full Gold Price Forecast, download the free guide from the DailyFX Trading Guides page