This may be the dawn of the electric vehicle era, but 2018 has been a phenomenal year for the humble internal combustion engine.

Among the most notable advancements: General Motors launched full-size pickups that can run on just two cylinders, Mercedes-Benz introduced its first new inline six-cylinder in more than 20 years, and Nissan Motor Co. brought out the industry’s first variable-compression engine, which uniquely balances fuel economy and power. Meanwhile, suppliers have been pumping out fuel-saving technologies at a furious pace.

“Gasoline engines are going to remain very, very relevant for a long time,” said Ed Kim, vice president for industry analysis at AutoPacific. “Because even with this push towards electrification, the point where we get to a full battery-electric fleet across the country is very far away.”

Despite the hype generated by Tesla, even the most bullish forecasts call for full EVs to account for only around 8 percent of the U.S. market by 2025. They represent less than 2 percent today.

To serve the other 90-some percent of buyers, automakers are investing in new engine architectures and technologies that boost power, reduce emissions and increase efficiency. Toyota Motor Corp., for example, plans to replace almost all of its engines between now and 2023, with 17 versions of nine new engines scheduled to arrive just in the next three years. And Fiat Chrysler Automobiles is working on a 3.0-liter turbocharged inline six-cylinder that could replace some V-8s; it’s likely to start showing up in Jeep vehicles around 2020.

“I wouldn’t see the termination” of internal combustion engines on the horizon, Volkswagen CEO Herbert Diess told Automotive News. “We are still working on the next generation of gasoline engines. They will become more fuel efficient. We will have 48-volt start-stop systems and mild-hybrid systems. There is still a lot of improvement going in there. But, on the other hand, the improvement — engine generation after engine generation — will be reduced because there’s just not much more [efficiency] in this. The low-hanging fruits are gone.”

ICE investment

The number of new engine architectures will slow in the coming years, but automaker investment on internal combustion will remain robust, said Mike Omotoso, business development manager for supplier Dayco Products and a former analyst.

“We are seeing OEMs steadily improve on existing engine families and programs to make incremental gains in fuel economy,” Omotoso said. Dayco’s engineers are working on lightweight compounds for timing belts and accessory drive belts; a damping, decoupling and overrun system that would be packaged with stop-start systems; and lightweight pulleys, idlers and tensioners.

Ford Motor Co. spokesman Wes Sherwood said the automaker is not taking its foot off the gas pedal on engines while also investing $11 billion to bring 40 electrified models to market by 2022. Ford says 16 of those will be battery-electric, the rest hybrids.

This year, Ford has launched two new engines: a 3.0-liter diesel for the F-150 and, on European vehicles, a new 1.5-liter three-cylinder EcoBoost engine that has cylinder deactivation and can run on two cylinders.

“We believe the powertrain revolution will actually be a relatively smooth transition blending conventional engines with electrified and other technologies,” Sherwood said. “Still, the internal combustion engine will be the engine of choice for the foreseeable future even as they increasingly are combined with electrified powertrains for hybrids and plug-in hybrids. While the technologies are shifting, the demands from our customers continue to get more diversified, which will require choice in powertrains. That’s why we are investing so heavily in EcoBoost, diesel and electrified technologies at the same time.”

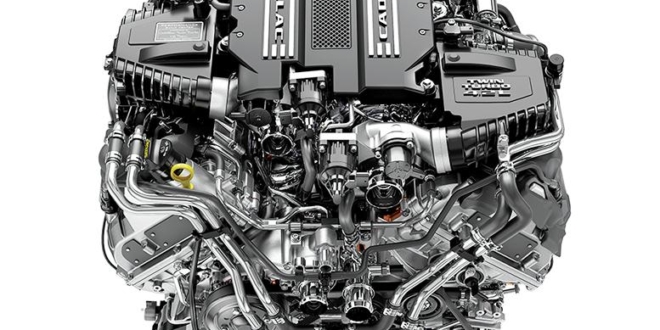

GM’s first twin-turbo V-8 is going into the Cadillac CT6 V-Sport. British engineering firm Cosworth is building the alloy cylinder heads.

Cosworth, the British engineering firm most noted for its high-performance racing engines, opened a manufacturing plant and headquarters near Detroit this year. One of the first products it makes will be cylinder heads for Cadillac’s new twin-turbo V-8. Cosworth CEO Hal Reisiger told Automotive News that he sees a convergence of gasoline engines and electric motors — and the company is already working on a project melding the two.

“We are looking at a development program where we are integrating an electric motor directly onto the internal combustion engine,” Reisiger said. “We think that has a lot of value for automakers. And that’s the direction we are headed.”

Mercedes’ new inline-six also has some of those attributes.

Diesel under siege

There are, however, dark clouds over one version of the ICE: diesel.

Even before VW’s diesel emissions cheating scandal broke in fall 2015, the oil-burning engine was under scrutiny by European governments for degrading air quality in cities and causing health problems. Nitrogen oxides from diesel exhaust have been linked to respiratory problems.

Reisiger: Vision of convergence

VW’s admission to using “defeat device” software so its diesel-powered cars could pass laboratory emissions tests — despite emitting illegal amounts of pollution on the road — brought other automakers’ diesel engines under scrutiny.

In the last two years, sales of diesel-powered vehicles have plunged in Europe, where some cities and countries are working to ban them, including a 16 percent drop in the first half of 2018. European automakers are working to quickly replace diesels with gasoline-electric hybrids. Volvo, for instance, has said the current generation of gasoline and diesel engines will be its last as it transforms its lineup to gasoline-electric hybrids and battery-electric vehicles.

ICE innovations

| A sampling of new engines going in current and future products | |

| GM | |

| 2.7-liter turbo 4-cylinder | 2019 Chevrolet Silverado/GMC Sierra |

| 3.0-liter inline-6 diesel | 2020 Chevrolet Silverado/GMC Sierra |

| 4.2-liter twin-turbo V-8 | 2019 Cadillac CT6 |

| FCA | |

| 3.0-liter inline-6 | Expected in 2020 on rwd vehicles |

| Ford | |

| 1.5-liter 3-cylinder with cylinder deactivation | 2018 Ford Focus (European model) |

| 3.0-liter turbodiesel | 2019 F-150 |

| Mercedes-Benz | |

| 3.0-liter inline 6-cylinder turbo | 2019 AMG E 53 |

| Nissan | |

| 2.0-liter variable-compression turbo | 2019 Infiniti QX50/Nissan Altima |

| Toyota | |

| 2.5 liter 4-cylinder; 40% thermal efficiency | 2018 Camry |

| 2.0-liter 4-cylinder; 40% thermal efficiency | 2019 Corolla hatchback |

In the U.S., diesel engines remain a mainstay in pickups and have seen growth, expanding to midsize trucks such as the Chevrolet Colorado and GMC Canyon, as well as the full-size Ram 1500 and Ford F-150. Diess, the VW CEO, says his company still believes diesels have a place in small cars in certain markets and is working on a new generation of engines.

“In many countries, you don’t have renewable energy available. And then, if you make the counts, diesel is probably still the best option for a low CO2-emission mobility,” Diess said. “We are just working on the next generation of diesel engines, becoming even cleaner now, with additional catalytic converters in the car, with additional effort on cleaning, and they become really clean now. We will have a market for these in Europe and many other places. Probably not here, because diesel here always was a niche on the passenger-car side. But also here, the bigger cars, the higher driving distances, diesel becomes more of a rational [choice]. When it comes to big SUVs, diesel still makes sense.”

Getting smaller

A big focus in the ICE world is making engines smaller — without a corresponding drop in performance.

GM used cylinder deactivation on its redesigned full-size pickups to accomplish that. Developed by GM and a California startup, Tula Technologies, the system, which GM calls Dynamic Fuel Management, varies the number of cylinders firing based on speed and load.

The old mechanical system could switch between eight-cylinder and four-cylinder mode. The new system can fire any number. Supplier Delphi Technologies is developing a similar system with Tula, called Dynamic Skip Fire, that is engineered to work on four-cylinder engines.

And older fuel-saving technologies, such as stop-start systems, have continued moving into the mainstream.

Tamez: Smaller engines complex

Internal combustion engines getting smaller and more complex is good news for at least some suppliers. Nemak, the giant engine casting firm in Mexico, is making smaller blocks and fewer cylinder heads, but the company also has broadened its business to include more machining. Now, it is delivering cylinder blocks and heads ready to assemble.

“Certainly, today we do see more smaller engines than in the past,” Nemak CEO Armando Tamez told Automotive News. “But we are seeing more complexity inside the blocks and the heads that allows us to add more value. For instance, in the past, cylinders had only two valves, Well, now everyone has moved to multivalve heads, and there are more passages than in the past. Plus, we have added more value in machining and even some assembly of components.”

New technologies

Suppliers continue to beat down automakers’ doors with innovations that make gasoline engines better.

Schaeffler has introduced two new valvetrain technologies that, combined, the supplier says can yield as much as a 15 percent increase in fuel economy. They replace old-style hydraulically operated valve components with electromechanical systems.

Last summer, at a technical symposium in Detroit for automakers’ engineers and Tier 2 suppliers, Germany’s Schaeffler Group demonstrated newly designed valvetrain components aimed at raising gasoline engine efficiency by double digits. They replace old-style hydraulically operated valve components with electromechanical systems.

One system uses a solenoid — an electric device that exerts mechanical pressure — on the camshafts to change the time and duration of when the valves open by switching to a second set of lobes on the cam. The other technology uses small electric motors to change cam phasing, the moment the intake and exhaust valves are opened. Both valve systems used together can yield as much as a 15 percent fuel economy gain, Schaeffler claims.

Another German supplier, Brose, has developed and is producing a line of electric water and oil pumps that deliver only the amount of water and oil needed to cool and lubricate the engine. The oil pump alone can improve fuel economy by 6 percent. Much of the company’s r&d efforts are focused on replacing hydraulic systems with electromechanical systems, said Frank Lubischer, Brose’s president for North America.

BorgWarner, Garrett Motion (spun off from Honeywell), Valeo and other suppliers have improved turbochargers to make smaller engines deliver sharper, more efficient performance. BorgWarner’s dual-volute turbocharger on the upcoming 2.7-liter turbo-four in the Chevrolet Silverado and GMC Sierra enables that engine to crank out V-8-like performance numbers of 310 hp and 348 pound-feet of torque. The next big innovation, a turbocharger powered by an electric motor — also called an electric supercharger — is just now arriving in luxury and high-performance vehicles from automakers such as Audi and Mercedes.

Government standards

Automakers had little choice but to invest heavily in internal combustion after the Obama administration subjected them to stricter fuel economy standards. Because EVs don’t sell in large enough numbers, automakers needed to develop more efficient gasoline-powered vehicles to meet the requirements.

They turned to smaller, more powerful turbocharged engines loaded with advanced fuel-saving technologies and transmissions sporting six or more gears. That and more lightweight vehicles helped propel the fleetwide fuel economy to a record 24.7 mpg in 2016, according to the EPA’s most recent data.

The Trump administration’s efforts to freeze fuel economy standards at the 2020 level have not yet become law, so automakers still must work to meet Obama-era requirements calling for a fleetwide average of about 47 mpg by 2025. (That number factors in credits for various technologies and doesn’t correspond to the EPA ratings shown on window stickers.)

Automakers have said that even if the fuel economy mandates were relaxed, global standards and environmental responsibility would ensure they keep investing in cleaner, more efficient internal combustion engines and new engine technologies.

Kim, the AutoPacific analyst, says even if fuel economy rules are rolled back, it might not change much.

Most global automakers, he said, will still need to invest in improvements to the gasoline engine. Because the same engines are sold globally, higher volume helps manufacturers lower parts costs and reduce manufacturing complexity, he added.

The comment period on the Trump administration’s proposed changes ended last month, so now the EPA and NHTSA must wade through more than 113,000 public submissions before the process to change the law can grind on. Legal challenges are likely to further delay any changes. California, gearing up for a heated battle with the White House on the 2021-25 targets, already has the support of about two dozen attorneys general in other states who also plan to fight the rollback effort.

“There is still plenty of work being done on the internal combustion engine,” Kim said, “and automakers are expected to continue forging forward.”