Talking Points:

- US President Trump and Chinese President Xi agree to a pause in the trade war escalation, but de-escalation remains far off

- Risk trends responded enthusiastically to the post-G20 news, but will the likes of the S&P 500 find a lasting rally in this news?

- AUDUSD carries more virtues in its US-China connections as well as lots of Aussie Data, USDCNH meanwhile will register little else

Does retail trader positioning in the S&P 500, AUDUSD and USDCNH change your view of the technical and fundamental potential following the G20 ‘break through’? See how retail FX and CFD traders are positioning on the majors, indices and commodities on the DailyFX Sentiment page.

Is this a True Turn in the US-China Trade War?

We start the new trading week with headlines of a ‘breakthrough’ in the escalating US-China trade war. It is natural for optimism to sweep in following months of a systemic theme steadily worsening, but that doesn’t mean that we should assume that relief is indeed a full reversal of fortune for the markets. Neither the fractured relationship between the two largest individual economies in the world has been set back on a stable course now has market appetite shifted to the point where any good information will be leveraged for unrestricted speculative build up. Arguably, skepticism is more deeply engrained in the markets now than any other general period over the past decade. The frequency of sharp selloffs this year and the growing list of existential threats make this hesitatancy well worth it. Reports crowded the headlines Saturday evening / Sunday morning that the US President Trump and Chinese President Xi had reached an agreement to headoff an anticipated esclation in the specific trade war between the two countries. Following threats by Trump these past few weeks that he would push forward with the jump in the tariff rate (from 10 to 25 percent) the open threat to take on the remaining $267 billion in goods China’s ships to the world’s largest consumer, there was market moving potential either way – bullish or bearish. With the announcement of a 90-day hiatus in the steady progression of the trade war, the path seems a meaningful improvement. That said, the probability that brief bouts of enthusiasm evolve into self-sustataining trned remains low. That is as much an observation of market conditions as it is the market updates themselves to start the week.

Risk Trends Are Embroiled in the Trade War, But That Isn’t the Only Game in Town

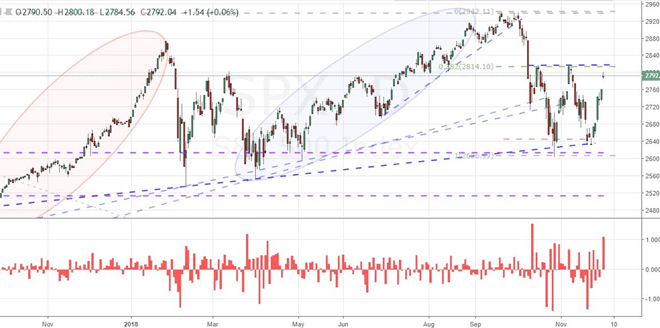

In tracking overarching fundamental trends for the market, one of the most pressing and all-enconsuming themes ties in to trade wars. Through the opening trading session of the week, there was a clear flare up in already-troubled growth. According to headlines to start the week, there was a notable turn off from the steadily escalation in trade risk when it was clear that the uneven accounts in US capital markets would head off a ready turn to self-sustaining speculative momemtum. When it came to the full scope of speculative to ensuring progress for the markets, there was little upon which the unsteady condition of risk targeting could potentially serve as the test bed for serious risk deployment in the months ahead. The United States had figured out that one of the critical meetings at the end of the speulative road. The S&P 500, Nasdaq 100 and other baselines de-emphasized reports progress on the fractured state of trade was leaving the key source of speculative ambush was in the wood. Forturnately, US traders were in little position to chase true risk aversion without something of greater depth. The US indices were among the best positioned assets on a technical and fundamental basis to take advantage of developments that genuinely inspired confidence in the state of risk trends that opened this weeks. The S&P 500 was already posting a course higher with the reversal stoked this past week week following the news that Fed Chairman Powell had made a concerted effort to deflate rate speculation moving forward. An improved relationship updated between the two largest economies suggests a rally should be easily developed, but there is good reason to remain skeptical of so easy a course. With technicals upon which to raise questions, there was notable lack of follow through on key assets from US indices posting dojis to carry trade to emerging market follow through and so on.

Chart of S&P 500 and Size of Gaps

Reducing the Competing Fundamental Themes with AUDUSD and USDCNH

In general ‘risk trends’ are difficult to plot. The burden is in the concept of speculative build up itself. There is far less confidence in ‘buying the dip’ or running on autopilot to trust speculative build up. In the updates for actual progress to start the new trading week there was precious little upon which to base the next leg of an already-long in the tooth bull trend. Perhaps if we could find a candidate thatcan capitalize on more. AUDUSD is such a pair where traditional risk trends is a factor, but there are other elements that can add to the picture. In particular, Australia is strongly connected to the health of China thanks to its direct export path of natural resource shipments to the larger economy which helped the island-nation stave off a recession to joint he rest of the top global economies during the 2008 Great Financial Crisis. It is likely that reality catches up to AUDUSD, but for now it may more readily find support than something like the S&P 500. Yet, before we grow too confident, traders should appreciate the unique fundamental event risk scheduled on the Australian economic docket. From an RBA rate decision to 3Q GDP to the trade balance, the currency’s immediate future is pockmarked by unetainty. That brings us to USDCNH. The pair at the dead center of the US-China trade spat would seem the most at-risk of recent developments, but the reality may be the exact office. It is still sensitive to risk trends but it is significantly reduced a motivation. Instead, the true relationship between the two will meaningfully test the market’s assumptions. There are fewer competing themes to keep track of and the Chinese authorities are likely to maintain the slide from USDCNH and perhaps even encourage it to support shortcomings elsewhere. We compare US equities to AUDUSD to USDCNH against speculative and conditional circumstances in today’s Quick Take video.

Chart of AUDUSD and Opening Gaps (Daily)

Chart of USDCNH and Opening Gaps (Daily)