Talking Points:

– US midterm elections are approaching on Tuesday, November 6, and given the ramifications for fiscal policy, there will be ramifications for financial markets as well.

– The most likely outcome, according to betting markets and opinion polls, is for Democrats to take a majority in the House of Representatives and for Republicans to hold a majority in the Senate.

– Sentiment has started to shift around the US Dollar ahead of the midterm elections, with traders neutralizing their positioning

See our long-term forecasts the US Dollar and other major currencies with the DailyFX Trading Guides.

With only days to go until November 6, financial market participants have begun to shift attention away from issues in Europe and Asia to the midterm elections in the United States. As is the case during midterms, every House of Representative seat is up for re-election (438 seats), while voters will elect one-third of the Senate (35 seats this year, due to two special elections).

Midway through US President Donald Trump’s first term, the election, as has been the case for every other president, is being viewed as a referendum on the policies undertaken during the first two years of the administration. While there has been a great deal of talk about flips, waves, or tsunamis in terms of the election results, here we’ll breakdown the numbers about the most likely outcomes and what impact to expect on financial markets thereafter.

Traders should start watching for meaningful results around 21 EDT on Tuesday, November 6 (2 GMT on Wednesday, November 7).

What Do Polls, Betting, and Prediction Markets Say?

For the past two years, both chambers of the US Congress have been controlled by President Trump’s Republican Party, helping usher through legislation bearing his signature (Morgan Stanley Research and CQ/Roll Call show that 98.7% of bills passed that the president supported).

However, various indicators suggest that the most likely outcome on Tuesday will be for a change in the current composition of Congress: Democrats will take a majority in the House of Representatives while Republicans will maintain control of the Senate.

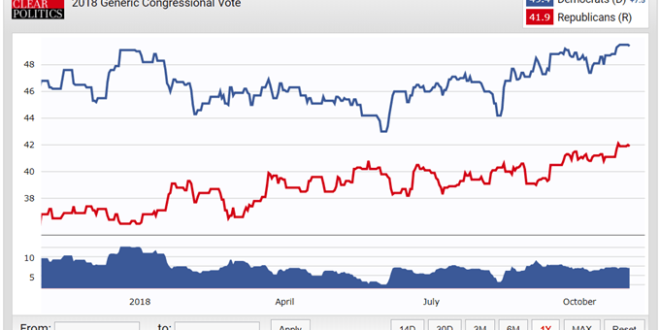

A aggregation of polls compiled by RealClearPolitics shows that voters have a significant preference for Democrats over Republicans in the upcoming Congressional elections.

Real Clear Politics: Generic Congressional Ballot (November 2017 to November 2018) (Chart 1)

Likewise, prediction markets foresee a Democrat-controlled House of Representatives, while Republicans will maintain control of the Senate coming out of the midterms; betting markets are no different:

PredictIt US House of Representatives Odds (August to November 2018) (Chart 2)

PredictIt US Senate Odds (August to November 2018) (Chart 3)

Accordingly, the following probabilities have been assigned to the various outcomes – and the one that could have the biggest impact is seeing its likelihood being reduced close to zero in the days before the midterms:

|

Scenario |

House of Representatives |

Senate |

Probability |

|

#1: Blue Flip |

Democrat |

Republican |

65% |

|

#2: Red Hold |

Republican |

Republican |

25% |

|

#3: Blue Wave |

Democrat |

Democrat |

10% |

*a fourth scenario, where Democrats take the Senate but Republicans hold onto the House, is viewed as close to a zero percent probability as possible given turnout models (i.e., it is impossible for Democrats to take the Senate without taking the House).

Scenario #1 – Blue Flip: Democratic House, Republican Senate

The base case scenario heading into the US midterm elections is for Democrats to flip control of the House of Representatives and for Republicans to retain control of the Senate. After two years of full control of the federal government by Republicans, a move back to a divided government would bring gridlock back to Washington, D.C.

Congressional gridlock under the Trump, like under the Obama administration, would mean that the current set of fiscal policies in place would likely be frozen; the Trump tax cuts would remain, but there wouldn’t be any more movement along that front. In this scenario, the trend of improved corporate earnings should continue, which means minimal negative impact on the stock market.

If there is one area of potential stimulus under Blue Flip scenario, it may be infrastructure spending. After all, President Trump has previously pledged a $1 trillion infrastructure spending program, a policy that never got any traction under the Republican-controlled House; instead, the stimulus policy pursued was the tax plan. But Democrats favored the infrastructure spending route more, and if President Trump wants to juice the economy further, this may be the lone area of agreement.

Meanwhile, even if a House controlled by Democrats means committee investigations and hearings, on say, banking deregulation, there is not much that can be done besides slowing the current trajectory of progress. Deregulation efforts will slow, not stop, as any efforts will be quickly stamped out by a Senate controlled by Republicans.

In terms of the Federal Reserve, while the near-term impact would be negligible (the Fed would still hike rates by 25-bps in December), it’s possible that market participants begin to cool down their expectations of such an aggressive rate path moving forward. The Fed is projecting three hikes in 2019, while rates markets are pricing in two, and furthermore are pricing in a cut in 2020.

|

Scenario #1 – Blue Flip: Democratic House, Republican Senate |

|

|

Instrument |

Impact |

|

DXY Index |

Less than -1% |

|

Less than -2% |

|

|

Spot Gold |

Less than +1% |

|

US Treasury 10-year yield |

-5-bps |

Scenario #2 – Red Hold: Republican House, Republican Senate

The second most likely result of the US midterms on Tuesday, November 6 is for no change at all: Republicans maintain control of both the House and the Senate. This would perhaps be the best outcome for risk assets, as the prospect for a continuation of the Trump tax cuts would undergird investor optimism in stocks. However, as was the case in the first two years of the Trump administration, it would be unlikely for an infrastructure spending plan to materialize.

To this end, if fiscal policy were to stay on its current trajectory (rather than being slowed in scenario #1), continuance of deficit spending would keep pressure to the upside on US Treasury yields. Similarly, retaining full control of the Congress would give Republicans the chance to further along deregulation efforts as well.

In the Red Hold scenario, the Federal Reserve would see no change in its plans, and would continue along its aggressive path of raising rates. This means a rate hike would materialize in December, and rates markets would likely pull up expectations from two to three hikes in 2019. Similarly, odds for a 2020 rate cut would probably be pushed back. This is the scenario that is most beneficial to the US Dollar and the worst for Gold in the short-term.

|

Scenario #2 – Red Hold: Republican House, Republican Senate |

|

|

Instrument |

Impact |

|

DXY Index |

Less than +1% |

|

S&P 500 |

Less than +2% |

|

Spot Gold |

Less than -1% |

|

US Treasury 10-year yield |

+10-bps |

Scenario #3 – Blue Wave: Democratic House, Democratic Senate

Of the three likely scenarios, a Blue Wave – Democrats take back control of the House and the Senate – is perhaps the one most widely discussed in the media. However, it also has the lowest likelihood of materializing, according to opinion polls, betting markets, and prediction markets. But this scenario would likely have the biggest impact on financial markets if it were to be realized.

Full control of Congress would mean that Democrats would effectively be able to put a halt to any of the Trump policies put in place during the first two years of the administration. Gridlock would return, but it would be more hostile than under scenario #1 (which would be more or less about fiscal stagnation). While Democrats would attempt to pass a number of spending plans, few if any would go anywhere with a Republican president still sitting atop the Executive Branch (akin to how very little legislation was passed when Republicans controlled both chambers of Congress while Democrat Barack Obama was president).

Under this scenario, there would be efforts to undo the Trump tax plan and replace it with a more progressive tax structure. While this may be beneficial (and necessary) for the US economy in the long-term, the prospect of a steeper tax structure is a definite negative for the corporate earnings outlook in the short-term. Similarly, deregulation efforts would nearly grind to a halt, although given that agency heads will still be Trump-appointees, some progress will still likely be made here.

For the Federal Reserve, scenario #3 poses the greatest risk to its current trajectory of policy. The reduction in deficit spending would likely filter into reduced inflationary pressures, which in turn could reduce the impetus for the Fed to raise rates as quickly as they have been (once every three months). To this end, rates markets would likely further reduce expectations for rate hikes in 2019, and pull forward the rate cut expectation for 2020.

|

Scenario #3 – Blue Wave: Democratic House, Democratic Senate |

|

|

Instrument |

Impact |

|

DXY Index |

Greater than -1% |

|

S&P 500 |

Greater than -2% |

|

Spot Gold |

Greater than +2% |

|

US Treasury 10-year yield |

-15-bps |

FX TRADING RESOURCES

Whether you are a new or experienced trader, DailyFX has multiple resources available to help you: an indicator for monitoring trader sentiment; quarterly trading forecasts; analytical and educational webinars held daily; trading guides to help you improve trading performance, and even one for those who are new to FX trading.

— Written by Christopher Vecchio, CFA, Senior Currency Strategist

To contact Christopher, email him at cvecchio@dailyfx.com

Follow him in the DailyFX Real Time News feed and Twitter at @CVecchioFX.