DailyFX Special Report Key Takeaways:

- Global Markets Have Rarely Ever Been More Correlated

- Investors and Traders looking for tactical plays should consider FX

- FX Reflects Global Market Developments That Will Make You A Better Trader

- IG Group, an institution for global traders, is now available in the US

Investors are always on the hunt. Stock traders are often looking for the perfect stock that balances growth and profitability while commodity traders are looking for price-charging imbalances between demand and supply. Following a similar formula, fixed income traders are typically looking for a balance of credit quality and yield with a background of relatively low inflation.

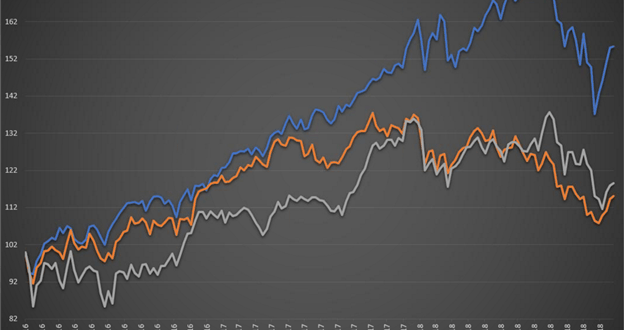

Global Markets Have Rarely Ever Been More Correlated

Data source: Bloomberg

Regardless of your asset allocation, the work of strategically and tactically picking how you are going to grow your portfolio is an evergreen issue. Naturally, as technology and globalization have advanced so have the need for traders to stay informed of driving themes and news developments that can disrupt the desired outcome.

For example, the global growth story increasingly must be filtered through the Chinese economy. A drop in Chinese demand hurts global commodity demand as well as high-flying, potentially fast-growth companies like Tesla that tap into the countries seemingly indefatigable expansion to support their growth forecasts.

The global financial markets have become increasingly coordinated, and much of that is also due to the actions of central banks as they looked to coordinate relief for investors to support asset prices. In 2019, the picture has rarely been as hazy post-financial crisis as it is today. This will likely lead to a jump in FX volatility that seemingly kicked off in October.

As markets become ever more global in scope, the largest players in the market are following systemic themes, and individual traders are taking note. In late 2017, Goldman Sachs put out their macro outlook for the year ahead. The top three trades were macro related, which were as follows:

TopTrade #1: Position for more Fed hikes and a rebuild of term premium by shorting 10-year USTreasuries.

TopTrade #2: Go long EUR/JPY for continued rotation around a flat Dollar.

TopTrade #3: Go long the EM growth cycle via the MSCI EM stock market

index.

For 2019, Oppenheimer funds came out with their key Macro & Investment views that focused on global expansion as US growth slows, fading effects of US monetary policy, and stabilizing Chinese growth, supporting Emerging Markets and Europe together.

It is not difficult to spot the theme. These institutions are focus on international market opportunities along with their related themes, and many traders are doing the same as we do at DailyFX.

Traders Looking for Tactical Global Plays Should Consider FX Markets

Traders tend to choose how and what they trade based on their objectives for risk and return as well as their constraints around time, liquidity, or other unique circumstances. Additionally, traders tend to look for themes and stories that align with potential large price moves.

In today’s world, traders now look around the world for the next great growth story or liquidity-driven bull/bear market. To many, ETFs (Exchange Traded Funds) are a way to play such themes owing to their ability to reflect unique aspects of the market and focus those qualities into an investment vehicles. Traders have voted with their investing dollars as the fund market has swelled to $5T according to Bloomberg.

ETFs are often seen as a solution to the difficulty of investing in places around the world where opportunities can quickly swell. However, ETFs often fall short on offering the scale of response and sensitivity that investors seek when they want to trade a theme.

Data source: Bloomberg

Global plays are increasingly common among individual accounts and professionally managed accounts. Traders are often looking for ways to play either growth or value trades when they buy ETFs or trade inverted ETFs that are a proxy for short selling.

However, traders who invest in ETFs may eventually realize (as I myself have) that something is amiss especially when they venture away from traditional benchmarking. Real Vision Television recently hosted a three-part interview with Steve Bregman titled the ‘Dark Magic’ of ETFs that focuses on blind mispricing, inappropriate allocation of stocks within an ETF, and worst of all pockets of illiquidity with leveraged ETFs.

Equities are sought for the reward they can potentially bring investors. However, traders are finding themselves increasingly doubting the earnings and dividend growth of many companies that have driven the markets.

Equity Market Volatility – FB, AMZN, AAPL, NFLX, GOOG (aka FAANGs)

Source: Bloomberg

Traders May Want To Consider FX Trading With IG in 2019 & Beyond

Traders at one time or another, tend to come across the enduring classic, Market Wizards, Interviews with Top Traders by Jack D. Schwager. The book details how the world’s most successful traders operated within various markets with a focus on currency trading to open the book. The follow–up bookHedge Fund Market Wizards: How Winning Traders Win also begins with great market participants pursuing macro exposure like currencies to best play high-level themes and developments.

Sometimes, traders look for stocks of companies with international exposure that they may find locally or commodities that are demanded by multiple nations for growth like oil. However, when a developing story takes hold that effects entire economies, traders can look to play these large themes via the FX markets. Here are a few examples:

- A country with above-trend growth like the US Economy in 2018 leading to outsized US Dollar gains

- Canada’s significant exposure to crude oil leading to the correlation between its currency and commodity as in 2015 leading to the formers decline into early 2016 as the latter deflates

- Central bank plans to jump start their economy and/or inflation via monetary policy like the Bank of Japan (BOJ) and European Central Bank (ECB) translating into strong Yen and Euro trends.

- The UK’s decision to withdrawal from the EU (Brexit) which led to a 21% drop of the British Pound against the US Dollar over the 3-months through October 2016.

US Traders Now Have A New Option On How To Execute FX Trades Through IG Markets.

IG GROUP APPROVED BY U.S. REGULATOR FOR RETAIL FOREIGN EXCHANGE DEALER (RFED) LICENSE

IG Markets has 45 years of market experience on a global scale. IG was founded in 1974 and listed on the FTSE 250, IG Group has offices in 14 countries across five continents and is now a step closer in returning to the U.S. market.

After applying for membership back in 2017, IG Group was granted regulatory approval on October 15, 2018, by the National Futures Association (NFA) as a registered Retail Foreign Exchange Dealer (RFED).

IG Group is also authorized and regulated by the Financial Conduct Authority (FCA), serving over 195,000 clients worldwide, and has been recognized time and time again for both its services and technology. As an industry leader, IG Group has undertaken the FX Global Code of Conduct and has been on the forefront in delivering world-class client support through innovation.

In 2016, IG brought DailyFX into IG Group to help traders navigate global markets, which independent traders are increasingly turning toward to get the most out of markets. If you have questions about trading with IG Markets US, please feel free to contact DailyFX or IG US.

FX Publications Inc (dba DailyFX) is registered with the Commodities Futures Trading Commission as a Guaranteed Introducing Broker and is a member of the National Futures Association (ID# 0517400).

Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors.

We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. You may lose more than you invest.

We recommend that you seek independent advice and ensure you fully understand the risks involved before trading.