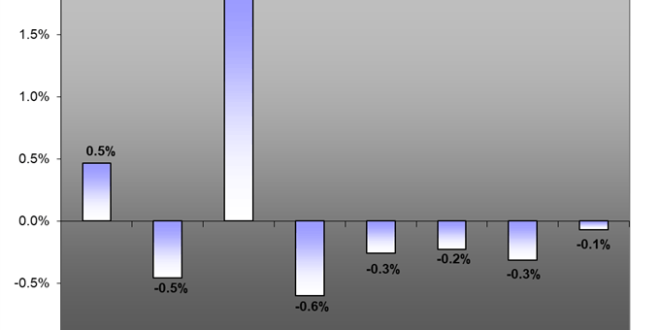

Following a week of better-than-expected Euro-area GDP, US employment statistics and the Fed’s confusing stance; we find the markets lacking a sense of conviction on basic sentiment. While there are a host of key events ahead (UK GDP, China trade, RBA rate decision) will expected progress on trade wars help reestablish a clear course?

Check out our Economic Calendar for upcoming economic data and central bank events.

Australian Forecast: Australian Dollar Could Face First RBA Rate Cut Since August 2016

The Australian Dollar heads into a new week battered by more feeble data and with more to play for at an RBA meeting than usual.

GBP Forecast: Sterling (GBP) Price Outlook: Brexit Anger May Dampen Sterling Strength

UK politics look set to re-assert themselves and Sterling is very likely to suffer.

Gold Forecast: Prices May Fall as Dollar Gains on Fed Policy Bets, Risk Trends

Gold prices may fall as a downbeat view on global growth coupled with fading hope for imminent Fed stimulus sours sentiment, boosting the US Dollar.

Euro Forecast: EURUSD at Risk to Bearish Euro Sentiment and EU-US Trade War Fears

The Euro struggled appreciating despite Italy climbing out of a technical recession and improving Eurozone data. Fears of an EU-US trade war and sentiment signals may sink EUR/USD.

Equity Forecast: Dow Jones, S&P 500, DAX 30 and FTSE 100 Price Outlook

After a loaded week for US equities, event risk looks to subside as the S&P 500 and Dow Jones look for the path of least resistance.

See what live coverage is scheduled to cover key event risk for the FX and capital markets on the DailyFX Webinar Calendar.

See how retail traders are positioning in the majors using the IG Client Sentiment readings on the sentiment page.