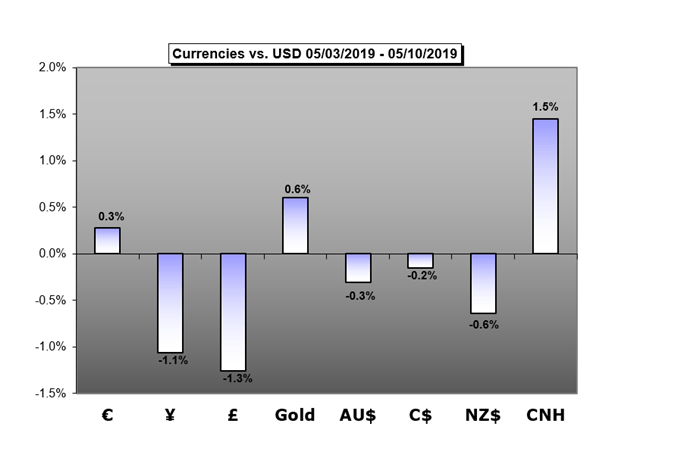

This past week closed to a dramatic increase in the US-China trade war terms…and yet the markets seemed to simply shrug the news off. Complacency is increasingly dangerous with growth signals flagging and Trump considering another course trade conflict via autos.

Check out our Economic Calendar for upcoming economic data and central bank events.

AUD Forecast: Australian Dollar Could Get Some Respite If Employment Keeps Revving

The Australian Dollar is stuck between global risk appetite and domestic monetary policy. Official Australian employment data may offer some temporary diversion.

Crude Oil Forecast: Prices Under Pressure From Souring Global Sentiment

Crude oil prices will likely continue to find themselves jerked between oscillations in market sentiment as fundamental themes increase pressure on investors.

USD Forecast: Torn Between S&P 500 Outlook, Dovish Fed as US Dollar Ranges

The US Dollar is facing competing fundamental forces as DXY eyes potential congestion. While USD may gain on US auto tariff fears, European data and US retail sales could be a risk.

Gold Forecast: Prices Susceptible to Upbeat US Data Despite Threat of Trade War

The current environment may continue to drag on the price of gold as the Federal Reserve remains in no rush to alter the outlook for monetary policy.

Equity Forecast: Dow Jones, DAX 30 and Nikkei 225 Fundamental Forecast

Trade wars were the dominant theme last week and could be again next week for the Dow Jones, DAX 30 and Nikkei 225 as President Trump weighs the option to impose auto tariffs.

See what live coverage is scheduled to cover key event risk for the FX and capital markets on the DailyFX Webinar Calendar.

See how retail traders are positioning in the majors using the IG Client Sentiment readings on the sentiment page.