GBP/USD, USD/CAD, Oil Price Analysis & News

GBP/USD Becoming Increasingly Sensitive to Risk Assets

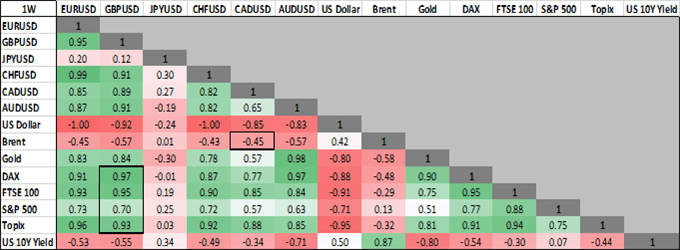

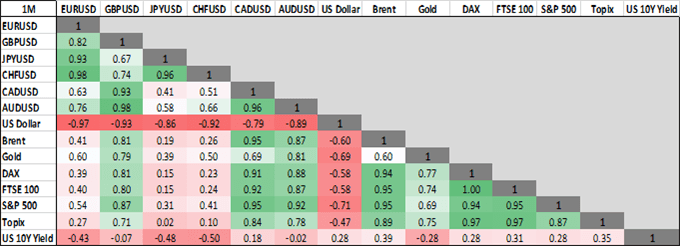

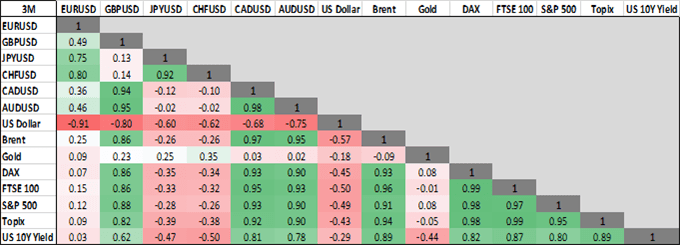

In the previous cross-asset correlation report, we had noted that the Pound has become increasingly more sensitive to risk appetite, compared to previously in which the currency had sat in the middle of the risk on-risk off spectrum. This has been further highlighted in the 1-week correlation matrix, showing that GBP/USD has the most positive correlation with global equities (even more so than the Australian Dollar). As we have alluded to previously, the fact that the Pound has a large twin deficit, with the current account deficit among the largest in the G10 complex, means that the UK needs constant inflow of foreign capital. That said, the Pound is likely to take its cue from the macro backdrop as opposed to idiosyncratic factors for now.

| Change in | Longs | Shorts | OI |

| Daily | 1% | 8% | 3% |

| Weekly | -5% | 10% | -1% |

Canadian Dollar and Oil Relationship Breaking Down

In recent sessions, the Canadian Dollar has seen its positive correlation with oil breakdown. We feel the reason behind has been due to the fact that the price action in the US Dollar has been the dominant force over the past few weeks. That in mind, while oil prices are having a limited impact on the Canadian Dollar at present, the fact that oil prices are finding a range we feel provides a degree of stabilization in the Loonie. Earlier in the week, the Federal Reserve announced a gamechanger in the form of unlimited QE, while addressing dollar shortage concerns through USD swap lines, which has allowed for a corrective move lower in the greenback. As such, the Canadian Dollar has been on the front foot, however, we still see risks to the downside for equity markets as country lockdowns are extended. Therefore, with safe-haven flows benefitting the greenback we still see upside risks for USD/CAD above 1.40, while CAD/JPY may also offer value on the downside after the Japanese fiscal year end come April.

Recommended by Justin McQueen

Download our Equities Forecast

How to Invest During a Recession: Investments & Strategy

Figure 1. Cross-Asset Correlation (1 Week, 1 Month & 3 Month Timeframe)

Source: Refinitiv, DailyFX. The Topix is used as a proxy for the Nikkei 225.

— Written by Justin McQueen, Market Analyst

Follow Justin on Twitter @JMcQueenFX