AUD/USD OUTLOOK

- China continues to weigh negatively on the Aussie dollar.

- Bearish IG client sentiment.

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

The Australian dollar looks to claw back some of its lost gains against the U.S. dollar on Friday as risk appetite seems to be on the rebound. After falling to fresh yearly lows yesterday, the commodity currency does not sit in a favorable position going forward primarily due to Chinese growth forecasts. The ‘zero tolerance’ policy by the Chinese government against COVID-19 has severely impacted on commodity demand leaving the AUD exposed to sustained downside should the situation remain.

The saving grace for the Aussie dollar lies with the extremely tight labor market and rising inflationary pressures, allowing the Reserve Bank Australia (RBA) to action an aggressive rate path. While the dollar remains favorable and we are likely to see ‘buy the dip’ conditions, the Australian dollar is one of the only global central banks that has the local economic backdrop to challenge the hawkish Fed. Should Chinese restrictions ease, I would not be surprised if we see the AUD lead the charge against the greenback.

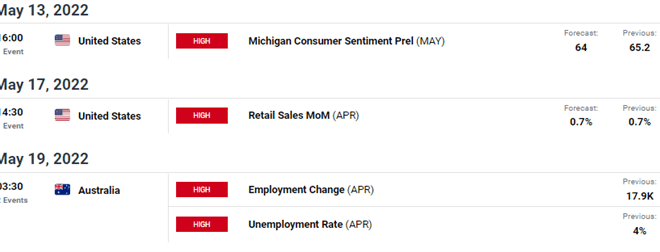

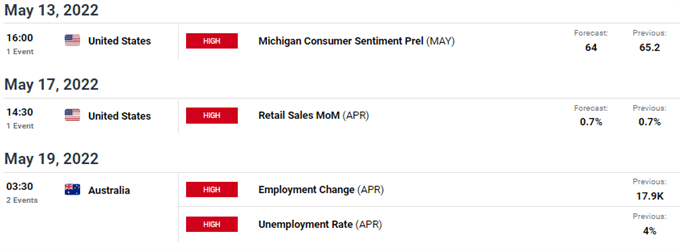

AUD/USD ECONOMIC CALENDAR

We end the week off with U.S. consumer sentiment figures while we look forward to next week’s Australian jobs data.

Source: DailyFX economic calendar

AUD/USD TECHNICAL ANALYSIS

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, IG

Daily AUD/USD price action shows bears looking to focus on the June 2020 swing low at 0.6777 but bullish divergence may indicate short-term upside before a resumption of the downtrend. Bullish divergence occurs when prices drift lower while the corresponding RSI readings push higher.

Key resistance levels:

Key support levels:

IG CLIENT SENTIMENT DATA: BEARISH

IGCS shows retail traders are currently LONG on AUD/USD, with 75% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a downside bias.

Contact and follow Warren on Twitter: @WVenketas