GBP/USD, EUR/GBP Analysis and News:

- Russian-Ukraine Conflict Continues to Drive Market Sentiment

- BoE Hawk on the Wires, However, the Case for a 50bps Hike Fades

Russian-Ukraine Conflict Continues to Drive Market Sentiment

Markets remain fixated on the rising tensions between Russia and the Ukraine, which took a turn for the worse yesterday after Russian President Putin recognised the independence of Donetsk and Luhansk. In effect, this will provide the pretext for Russian troops to cross the border as peacekeepers. Meanwhile, Western countries will set out a list of sanctions, with UK PM Johnson stating that they will be announced later today, the main question is whether sanctions will be coordinated with the likes of the US and the EU, particularly the latter, given that they have more to lose economically. That being said, while the equity space remains under pressure and Brent crude oil futures edge towards the $100/bbl mark, FX markets are somewhat sanguine as cross-JPY bounces back from the lows, while the Euro in fact hovers around intra-day highs. Now while I am a medium term bull on the Euro, with geopolitical risks unlikely to dissipate in the near future, risks are geared to the downside for the single currency.

How to Trade the Impact of Politics on Global Financial Markets

BoE Hawk on the Wires, However, the Case for a 50bps Hike Fades

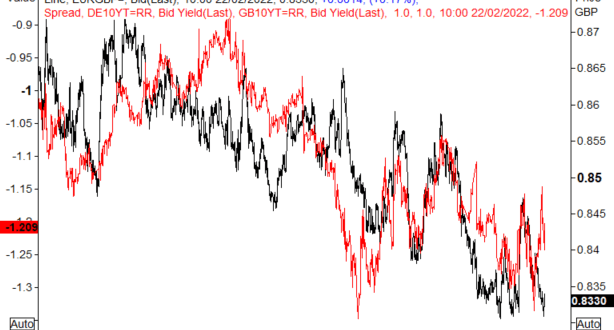

Away from geopolitical conflict, GBP watchers will keep a close eye on the latest speech from BoE Hawk, Ramsden (10:45GMT). A reminder that the rate setter was in the minority, voting for a 50bps rate rise. Of course, while the recent plethora of economic data will likely embolden his view that a 50bps hike was and is justified, commentary regarding the ongoing Russia-Ukraine conflict will be noteworthy, with any hints of reigning in hawkish expectations likely to prompt a fresh leg lower in GBP. As it stands, I remain in the camp for another 25bps rate rise. The Pound is slightly softer to begin the session, which is largely a factor of cross-related EUR/GBP buying, having held onto the 0.8300 handle. Meanwhile, GE/UK spreads point towards a firmer EUR/GBP (Figure 1.).

Figure 1. EUR/GBP vs GE/UK 10yr Spreads

Source: Refinitiv