Trading Earnings Season: 3 Steps for Using Earnings Reports

DAX 40: Rallies Higher as Poor German Data Fails to Dampen the Mood

The DAXtraded higher in European trade helped by strong corporate earnings and constructive sentiment. The early gains do seem tenuous at best ,however, as weak German retail sales data raised fresh doubts about the region’s economic recovery.

European markets started the new month with a degree of optimism as HSBC (LON:HSBA), the region’s biggest bank, raised its near-term return on tangible equity goal to at least 12% from 2023 onwards, expressing confidence in the future, and vowed to restore paying quarterly dividends next year. Its stock rose over 6%. Still, gains are limited in Europe as investors are worried about the likelihood of a recession in the region on the back of disappointing economic data.

How Central Banks Impact the Forex Market

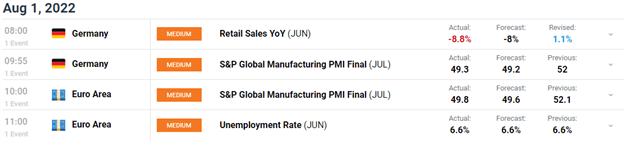

German retail sales plummeted in June as consumers cut spending on non-essential goods to cope with record inflation.Sales were down 8.8% from the previous year, the most in three decades. Non-food items such as furniture and household appliances or clothing and shoes registered even steeper declines.The data add to an already strained outlook. Europe’s largest economy is suffering like few othersas more and more economists argue that a recession later this year is inevitable.

Meanwhile, factory activity in the Eurozone contracted in July, with the region’s manufacturing PMI index falling to 49.8, compared with a reading of 52.1 the previous month, as inflationary pressures and macroeconomic uncertainty weighed on demand. This follows a worrying growing global trend as South Korea’s factory activity fell for the first time in almost two years, Japan saw its slowest growth in activity in 10 months, while in China the official measure of factory activity, released over the weekend, unexpectedly contracted in July amid fresh COVID-19 outbreaks.

For all market-moving economic releases and events, see the DailyFX Calendar

DAX 40 Daily Chart – August 1, 2022

Source: IG

DAX 40 2H Chart – August 1, 2022

Source: IG

From a technical perspective, last week Friday saw a monthly candle close as a bullish candle of a level of support. We closed above the 50-SMA while at the same time maintaining a bullish structure (higher highs and higher lows) on the monthly timeframe. The daily timeframe saw another bullish candle close as we now trade between the 50 and 100-SMA.

The 2H chart on the other hand saw the breakout of the trendline last week followed by a pullback before moving higher. We have just made a new higher high on the 2H and may see some pullback as we currently trade above the 20,50 and 100-SMA. Sellers may find interest at the 100-SMA around 13660.

Key intraday levels that are worth watching:

Support Areas

•13400

•13296

•13000

Resistance Areas

•13660

•13850

•14000

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter:@zvawda

https://www.dailyfx.com/forex/market_alert/2022/08/01/EURUSD-Outlook-Pressing-Higher-as-the-US-Dollar-Loses-Its-Shine-.html