DAX 40:Flat as Attention Turns to The ECB Forum.

- FTSE 100:Marginally Higher as Mining Stocks Lead the Way.

- DOW JONES:Technology Stocks Lead the Way as Treasuries and the US Dollar Slip.

DAX 40: Flat as Attention Turns to The ECB Forum

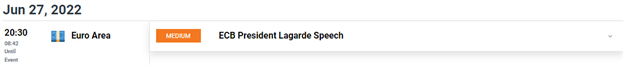

The Dax opened higher this morning following on from gains made in Asia and a late-week rally on Wall Street. Concerns eased regarding aggressive central bank actions and the possibility of a wider economic downturn. U.S. economic data recently has led some investors to rethink how aggressively global policymakers – and the Federal Reserve, in particular – will raise borrowing costs to combat soaring prices.Central bank watchers will be keeping an eye out for clues on how the European Central Bank (ECB) plans to curb inflation but also engineer a so-called “soft landing” for the wider economy at this week’s three-day forum in Portugal. These economic worries and the war in Ukraine will also top the agenda of a Group of Seven summit in Germany, which kicked off on Sunday.

The sectoral breakdown has all sectors in the red with the biggest losers being basic materials and healthcare. Notable movers include HelloFresh SE, Zalando SE and Siemens Healthineers with gains of 6.3%, 6.1% and 2.7% respectively.

Customize and filter live economic data via our DailyFX economic calendar

DAX 40 Daily Chart- June 27, 2022

Source: IG

From a technical perspective, we have bounced since creating a new monthly low (12833) last week. Friday saw a bullish engulfing candle stick on the daily chart which yet again failed to close above resistance area 13275. We have had a 270 point upside move in the European session, however price has since pulled back and seems pressured. A failure to close above the resistance level could leave us vulnerable to lower prices bringing the year-to-date low back into play. (See chart)

Key intraday levels that are worth watching:

Support Areas

Resistance Areas

FTSE 100: Marginally Higher as Mining Stocks Lead the Way

The FTSEstarted the week on the front foot as Russia looks set to technically default on its foreign debts for the first time in decades. A default comes as pressure mounts on President Vladimir Putin’s country as G7 leaders seek to impose a “price cap” on Russian crude in a bid to curtail its war funding. The levelling off of the oil price and the commodities slide have weighed against the indexrecently given its heavy general exposure, although losses have been marginal in comparison to the more severe losses seen by some global peers. As things stand the FTSE is down by just 2% in the year–to–date.

The FTSE sectoral breakdown has a host of sectors in the red with basic materials and energy leading the way. Notable movers include Easy-Jet PLC, Carnival PLC and Anglo-American PLC with gains of 4.2%, 3.9% and 3.6% respectively.

FTSE 100 Daily Charts – June 27, 2022

Source:IG

The FTSE closed with a bullish engulfing candle on Friday’s daily chart. Since the open we are up for the day as we approach our important resistance area at 7300, which lines up with the 38.3% Fib retracement level. We are approaching a key resistance area with a break above potentially leading to further upside targets at 7500 and beyond, while a rejection of this level opens up the possibility of a new low below our psychological 7000 level.

Key intraday levels that are worth watching:

Support Areas

Resistance Areas

DOW JONES: Technology Stocks Lead the Way as Treasuries and the US Dollar Slip

The technology sector heavyweights continue to boost US stocks on the back of a positive close last week.

Quarterly portfolio rebalancing by institutional buyers could be helping equities, as investors assess whether inflation is cresting, and a recession can be averted. JPMorgan Chase & Co.’s Marko Kolanovic is calling for stocks to rise 7% this week as pension and sovereign wealth funds shift their exposures. Traders are monitoring a summit of the Group of Seven leaders (G7), as they weigh a potential price cap for Russian Oil.

US durable goods orders MoM beat estimates with a print of 0.7% exceeding expectations of 0.1%. This gives an indication that demand for goods remains strong in the USA which might stoke inflation fears once more.

DOW JONES Daily Chart- June 27, 2022

Source: IG

From a technical perspective Friday’s bullish daily candle pushed the Dow above the key psychological level at 31000 as well as the resistance area around 31300. Given the sharp bullish move to end last week we could see some retracement back to the 31000 area before going higher with a potential third touch of the trendline. A break below 31000 could push price back toward the recent lows around 29600.

Key intraday levels that are worth watching:

Support Areas

Resistance Areas

Written by: Zain Vawda, Market Writer for DailyFX.com

Contact and follow Zain on Twitter: @zvawda