EUR/USD ANALYSIS

- Question marks around EU bond sale.

- EUR/USD potential to push lower.

EURO FUNDAMENTAL BACKDROP

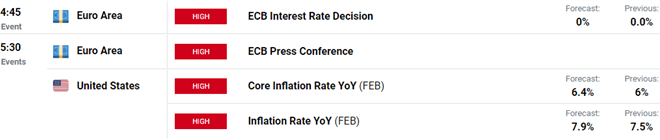

The announcement about the EU’s debt raising plan has been refuted by the EU’s Timmermans however, markets largely dismissed this with the Euro pushing higher today. EUR/USD is likely to remain subdued ahead of tomorrows stacked calendar with the ECB’s interest rate decision and U.S. inflation respectively.

Source: DailyFX Economic Calendar

As mentioned in my analysis yesterday, we could see a shift towards fiscal intervention in attempts to minimize the inflationary impact on EU consumers. This could come in the way of tax cuts to offset rising commodity prices. Monetary will have minimal effect on inflationary pressure as supply constraints are the root cause of the current problem. The graphic below illustrates the expectations by money markets for a rate hold (92.14%) is almost fully priced in.

ECB RATE HIKE PROBABILITY:

Source: Refinitiv

TECHNICAL ANALYSIS

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

The daily EUR/USD chart shows the turnaround after a poor open to the trading week with bulls pushing the pair towards the long-term triangle support (black). This comes after positive news around Ukraine giving up the notion of joining NATO and hopefully decreasing violence in the region. This being said, the relief may be short-lived and price action looks to be setting up for another move lower as tensions are unlikely to dissipate quickly.

Resistance levels:

- 20-day EMA (purple)

- 1.1000

- Triangle support

Support levels:

IG CLIENT SENTIMENT DATA PUSHES BEARISH NARRATIVE

IGCS shows retail traders are currently LONG on EUR/USD, with 69% of traders currently holding long positions (as of this writing). At DailyFX we typically take a contrarian view to crowd sentiment resulting in a short-term downside bias.

Contact and follow Warren on Twitter: @WVenketas