EUR/USD Prices, Charts, and Analysis

- The EU economy ekes out minimal growth of 0.1% in Q1.

- Germany may enter a mild recession.

Recommended by Nick Cawley

Get Your Free EUR Forecast

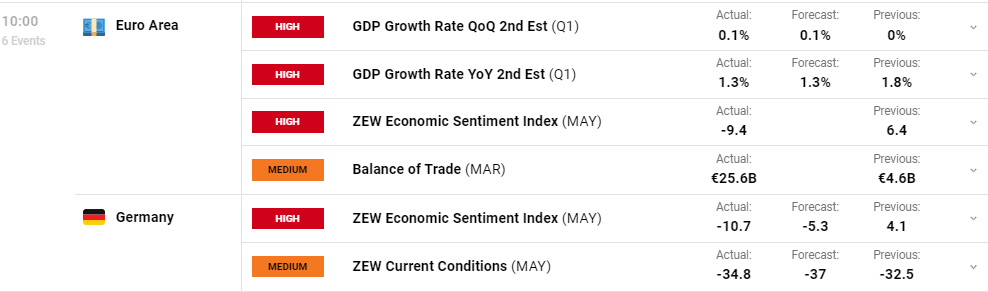

Seasonally adjusted Q1 GDP increased by 0.1% in the Euro Area and by 0.2% in the EU compared to the previous quarter, according to the second estimate published by Eurostat today. The Euro Area q/q and y/y data came in line with Eurostat’s preliminary estimate.

For all market-moving events and economic data releases, see the real-time DailyFX Calendar

The latest German ZEW indicator of economic sentiment missed market expectations and declined to -10.7, its lowest reading since December 2022. According to the data provider ZEW, ‘financial market experts anticipate a worsening of the already unfavorable economic situation in the next six months. As a result, the German economy could slip into a recession, albeit a mild one. The sentiment indicator decline is partly due to expectations of further interest rate hikes by the ECB.’

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

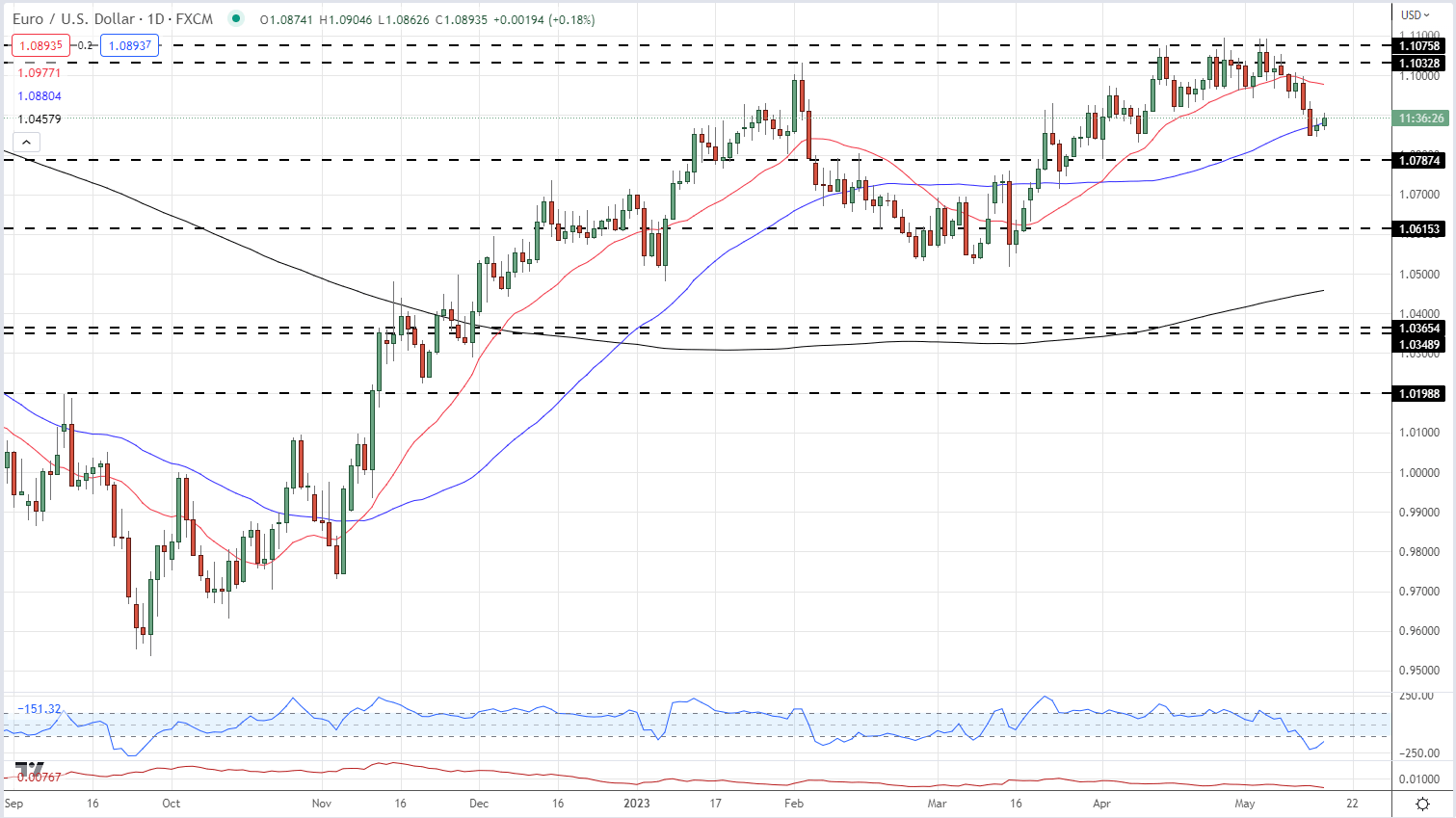

The two data releases barely moved the Euro in already thin trading conditions. EUR/USD remains just under 1.0900, aided in part by a slightly weaker US dollar. EUR/USD is trapped in a tight trading range with initial support at 1.0845 ahead of 1.0787. Initial resistance is seen around 1.0935 ahead of 1.1033. Both the 20- and 50-day moving averages are also in play and need to be watched.

EUR/USD Daily Price Chart – May 16, 2023

Chart via TradingView

| Change in | Longs | Shorts | OI |

| Daily | -4% | 8% | 1% |

| Weekly | 27% | -14% | 5% |

Retail Trading Bias is Mixed

Retail trader data shows 56.80% of traders are net-long with the ratio of traders long to short at 1.31 to 1.The number of traders net-long is 0.76% higher than yesterday and 41.69% higher from last week, while the number of traders net-short is 13.86% higher than yesterday and 14.14% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall. Positioning is less net-long than yesterday but more net-long from last week. The combination of current sentiment and recent changes gives us a further mixed EUR/USD trading bias.

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.