Euro Talking Points:

Recommended by James Stanley

Get Your Free EUR Forecast

The week started with some potential for volatility in FX markets but as the days have worn on, that flare of USD strength from Monday has continued to fizzle out.

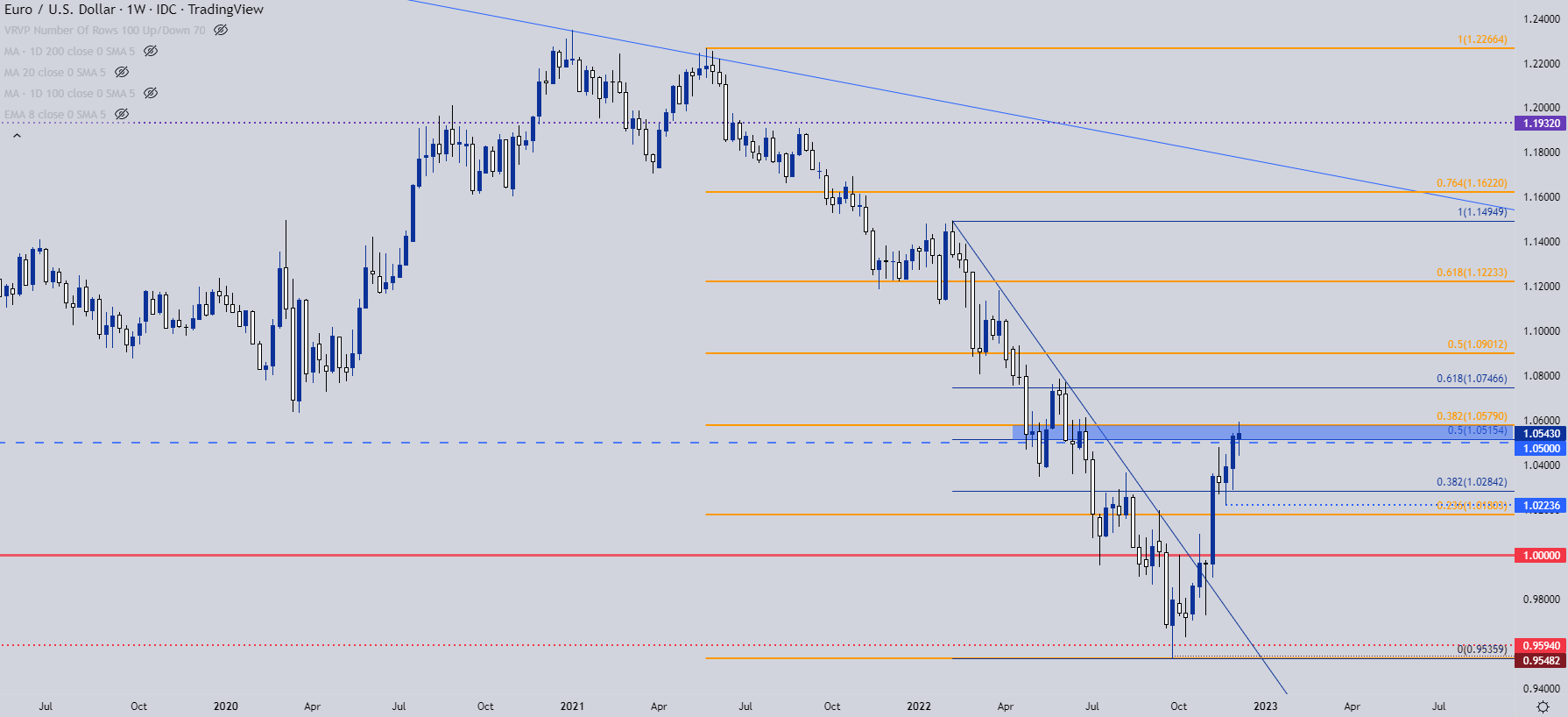

To open the week, EUR/USD tested a breakout beyond a key Fibonacci level at 1.0579. It snapped back pretty soon after, and this synced with a support bounce in the USD from one of its own Fibonacci levels. Initially this gave the appearance of trend potential, and the Monday session offered some run on both of those themes with even a bit of continuation on Tuesday. Yesterday, however, saw both themes pull back, with USD selling-off and EUR/USD pushing back above the 1.0500 level. This gives the appearance of anticipation for next week’s rather voluminous Central Bank outlay. Pertinent to EUR/USD, we’re hearing from the Fed (on Wed) and the European Central Bank (on Thurs). After that, we have but a couple of weeks until the end of the year so that drive on next week’s economic calendar is looking quite opportunistic for trend and breakout traders.

At this point, the weekly bar of EUR/USD is looking indecisive and is working as a doji. Given the blistering pace of gains from the September low, a doji at a key spot of resistance could be of interest for swing traders, but we have to confirm that first with this week’s close. And for that we have to get through some US data tomorrow with the release of PPI data at 8:30 AM followed by Consumer Sentiment at 10 AM (both times Eastern).

Recommended by James Stanley

How to Trade EUR/USD

EUR/USD Weekly Price Chart

Chart prepared by James Stanley; EURUSD on Tradingview

EUR/USD

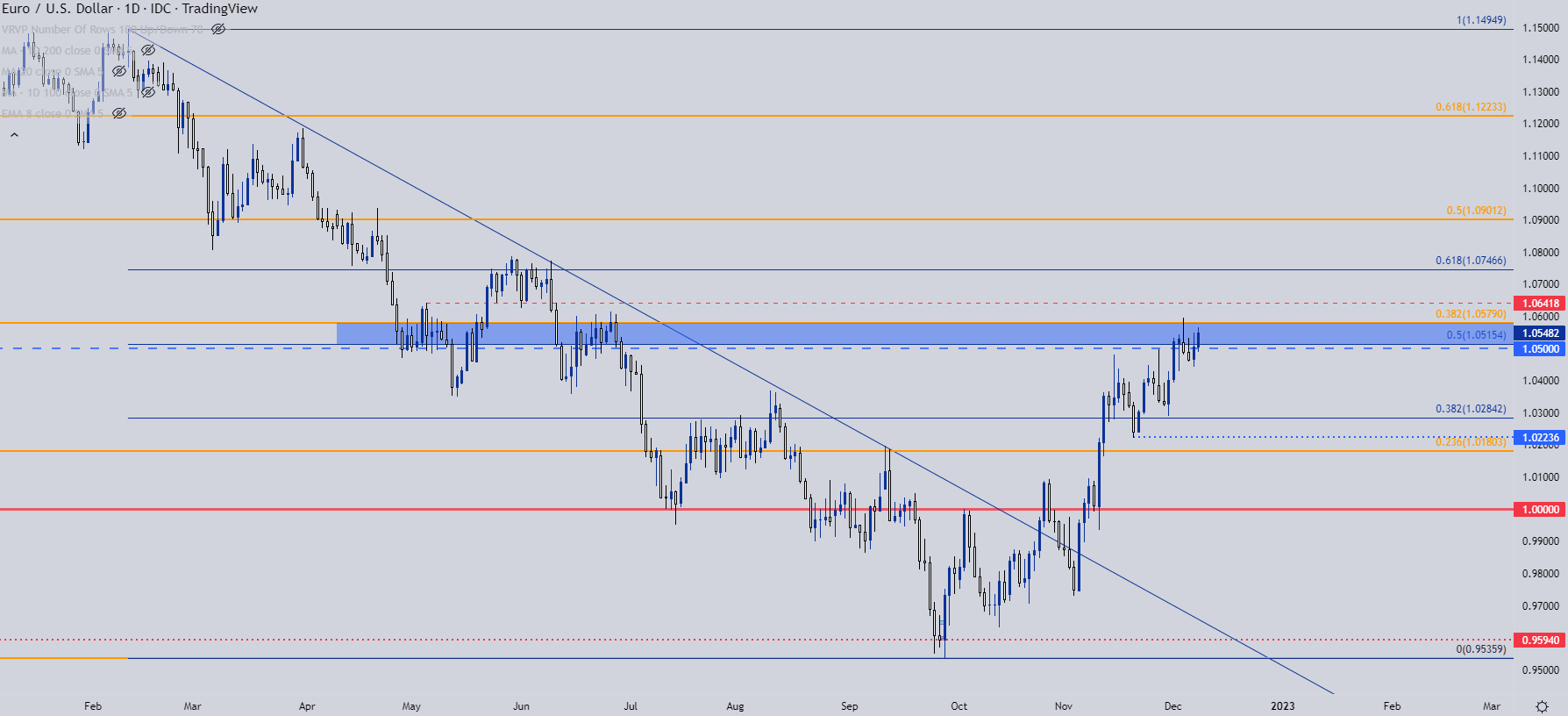

From the daily chart, we can see a key zone that’s in-play to hold the highs at the moment. There’s confluence between two Fibonacci levels of note, as the 50% mark of the Feb-Sept major move plots at 1.0515 and the 38.2% retracement of the longer-term sell-off, spanning from May of 2021 down to the September low rests at 1.0579. That was the level that was tested through on Monday before the short-term reversal showed up.

From the daily there are still up-trending tendencies and only early signs that a top may be in. What would be needed next is a lower-high, inside of the Monday high, combined with a lower-low, which could be sought below the Wednesday swing at 1.0450.

The alternative case would be an episode of capitulation, which could show in the event of a fresh high being met with intense selling pressure, thereby opening the door for reversal scenarios.

EUR/USD Daily Chart

Chart prepared by James Stanley; EURUSD on Tradingview

EUR/JPY

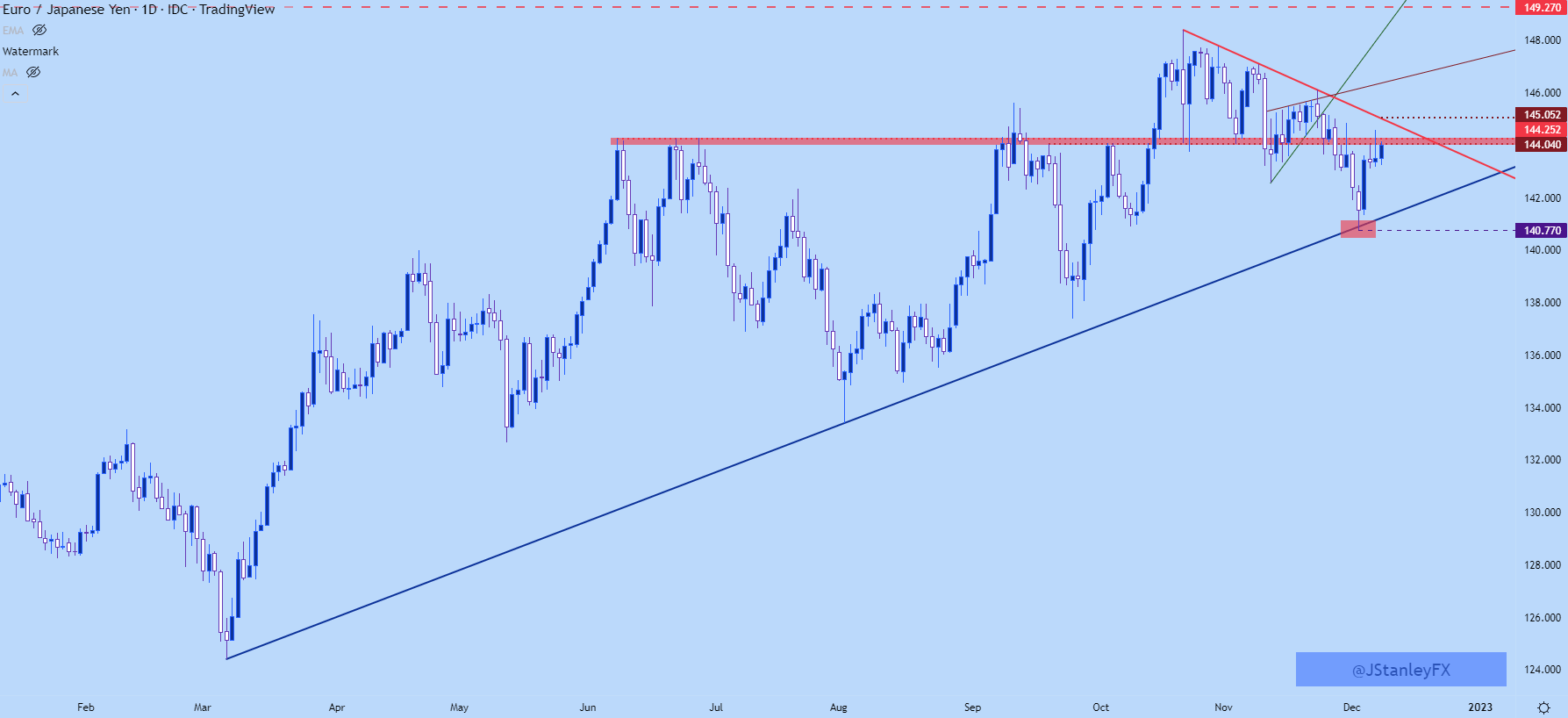

For Euro bears, there may be a more attractive setup elsewhere. EUR/JPY could be one of those candidates. Even as USD weakness has hung around, JPY strength has continued to show and in EUR/JPY, this led to a break of a rising wedge formation two weeks ago. Rising wedges are often tracked for bearish reversals, and that led into a push down to fresh monthly lows.

Bears then ran it down to trendline support with a low being set at 140.77 on Friday. Since then prices have bounced, and we’re now testing a familiar area of resistance-turned-support around the 144 handle. And just above, there’s another spot of resistance, as taken from a bearish trendline connecting a group of recent lower-highs in the pair. This currently projects to around the 145 level.

Recommended by James Stanley

Trading Forex News: The Strategy

EUR/JPY Daily Chart

Chart prepared by James Stanley; EUR/JPY on Tradingview

EUR/JPY Shorter-Term

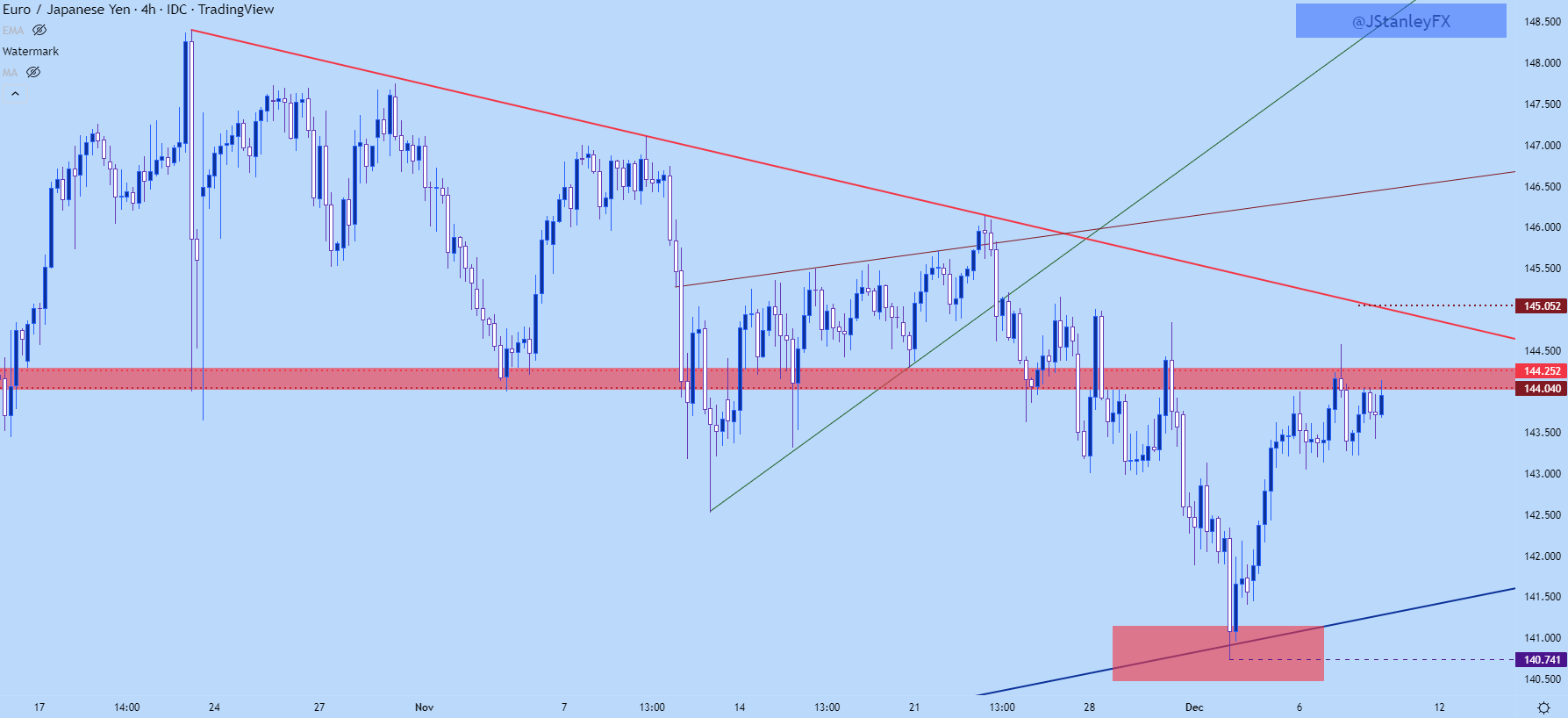

From a shorter-term basis, we can see where EUR/JPY tested above that resistance zone yesterday and quickly snapped back. This keeps the door open for swing potential, particularly if this zone of resistance can hold a lower-high below yesterday’s swing.

EUR/JPY Four-Hour Chart

Chart prepared by James Stanley; EUR/JPY on Tradingview

EUR/GBP

The range meets support…

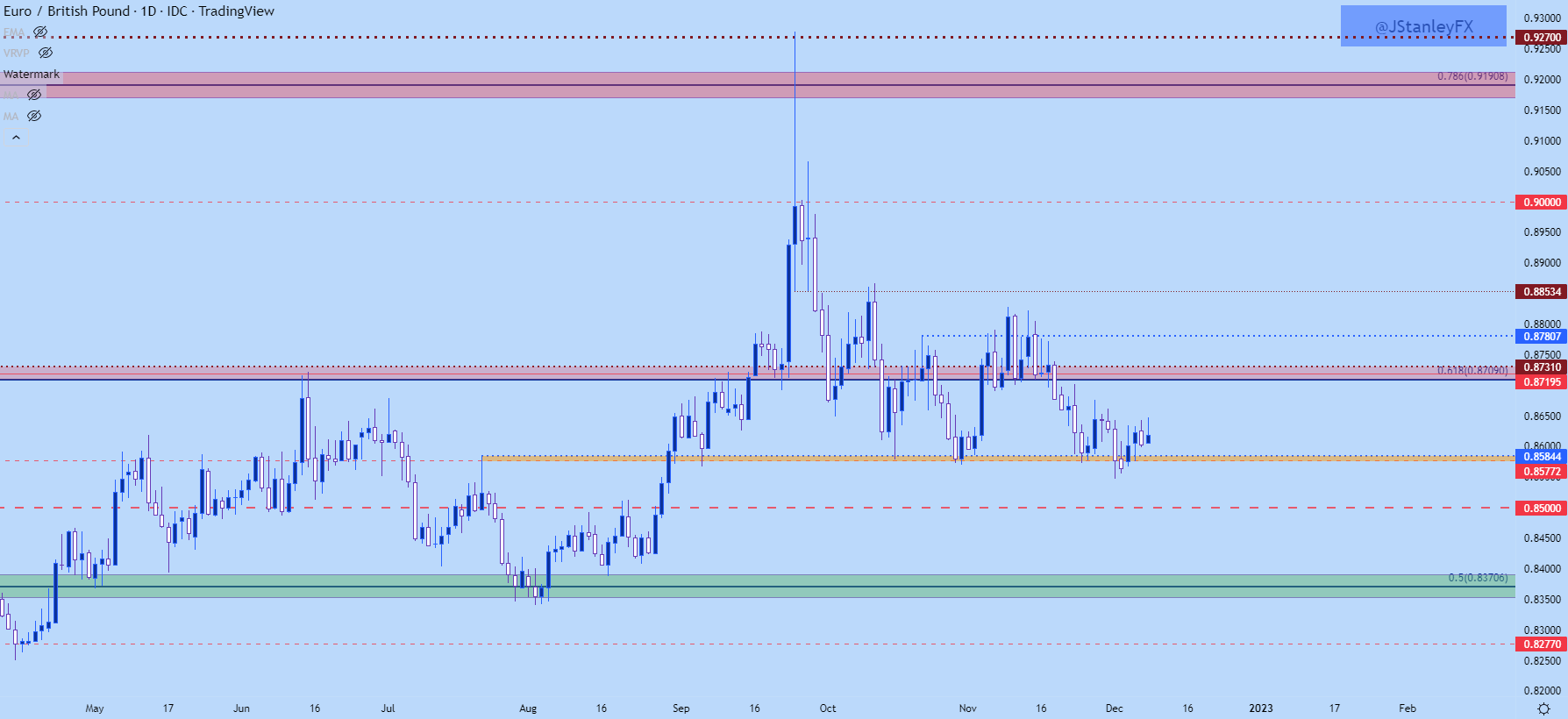

I had looked into EUR/GBP early last month, highlighting a bout of range resistance that had just come into the picture. Price took about a week but, continued to hold in that area without breaching the next resistance level on the chart at .8853. Then GBP strength started to show up and EUR/GBP began to trickle lower, eventually crossing the .8700 handle and then, as of last week, visiting range support around .8577.

So far this week a bounce has developed off of this support, but sellers have been standing at the ready, as highlighted by the upper wicks sitting atop the past three daily candles (four, if including today’s unfinished bar).

Recommended by James Stanley

Building Confidence in Trading

EUR/GBP Daily Chart

Chart prepared by James Stanley; EURGBP on Tradingview

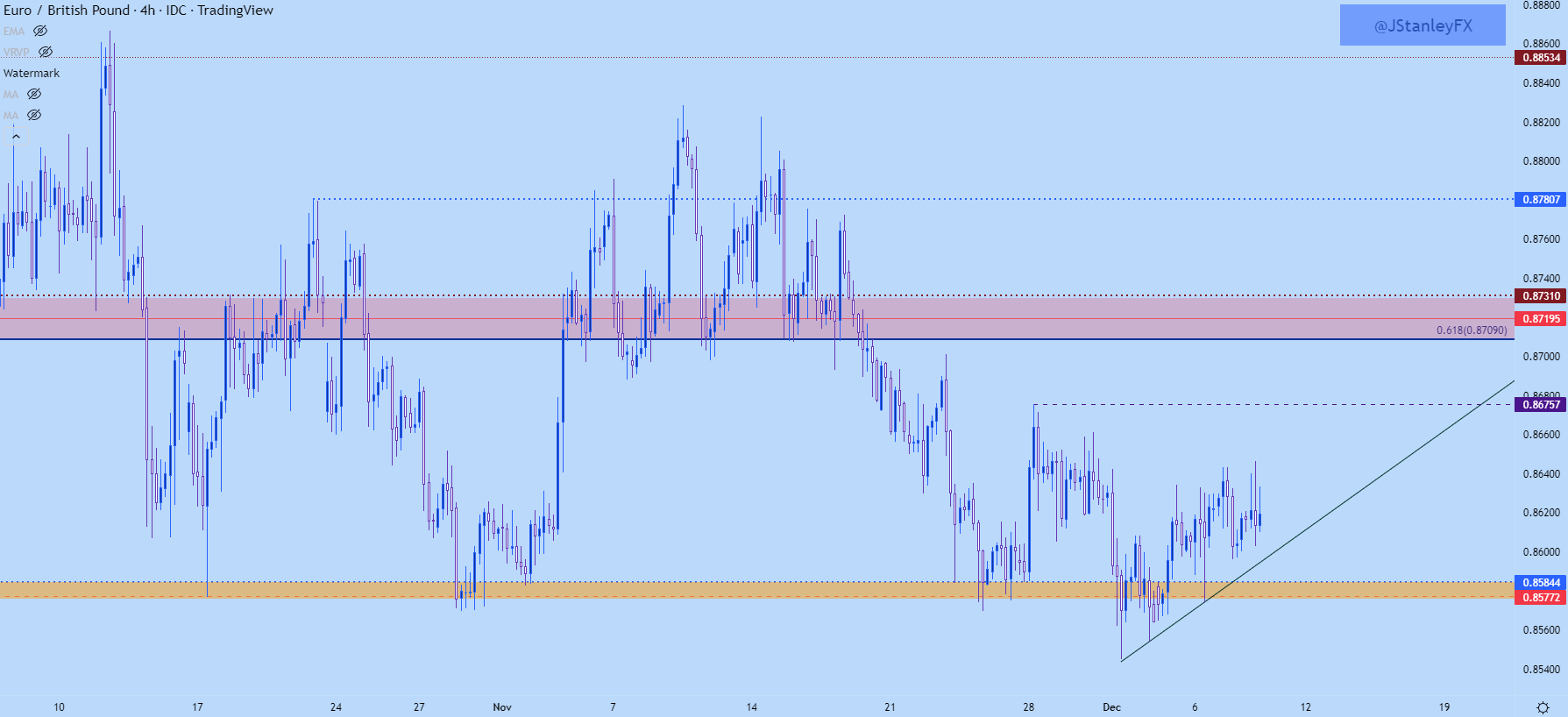

EUR/GBP Shorter-Term

Going down to the four hour chart, we can see an attempt at recovery. It’s still very early though, as price hasn’t yet been able to test through a prior lower-high around .8680. There has, however, been a string of recent higher-lows, and this can keep the door open for bounce scenarios in the pair until that string is broken. And for that, I’m tracking the Tuesday low at .8574. If bulls can hold the low above that level, the longer-term range scenario can stay alive with focus on revisits to .8676 after which the .8709-.8731 zone comes back into the picture.

EUR/GBP Four-Hour Chart

Chart prepared by James Stanley; EURGBP on Tradingview

— Written by James Stanley, Senior Strategist, DailyFX.com & Head of DailyFX Education

Contact and follow James on Twitter: @JStanleyFX