EUR/USD Price, Chart, and Analysis

- EUR/USD struggling to make any headway.

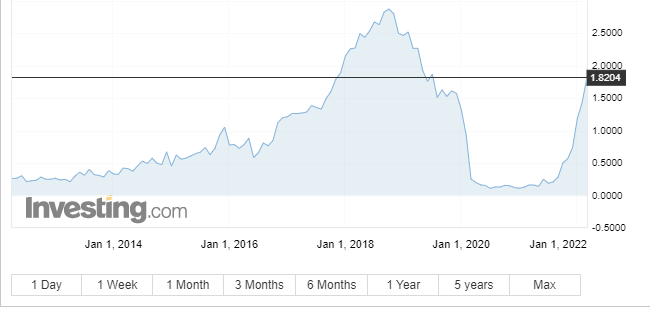

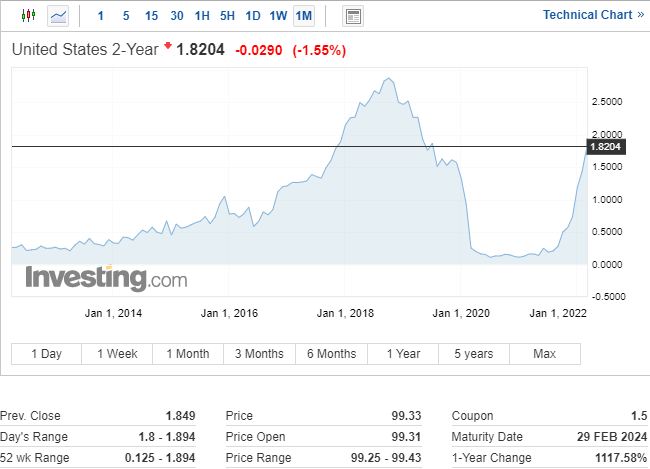

- US dollar strength underpinned by elevated US Treasury yields.

Federal Reserve chair Jerome Powell is expected to announce the first in a series of 0.25% interest rate hikes at tomorrow’s FOMC meeting. According to market thinking, this will be the first of seven quarter-point hikes this year with four more expected in 2023. These expectations have boosted the value of the US dollar over the last few weeks and traders will be looking, and listening, to chair Powell’s post-decision statement to see if he has turned further hawkish in the face of rampant inflation. US headline inflation touched 7.9% last week, a fresh 40-year high.

Chart and data via @Investing.com

For all market-moving data releases and events, see the DailyFX Economic Calendar

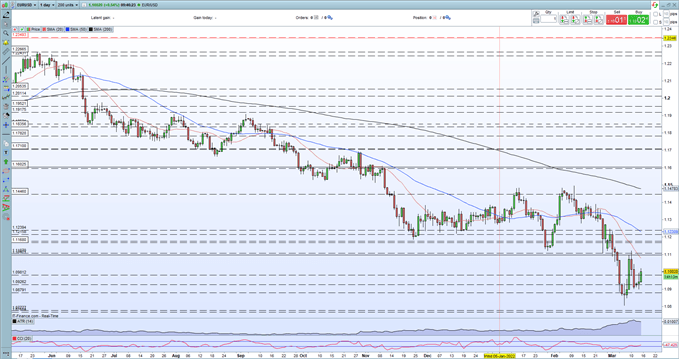

EUR/USD is trying to edge higher but the move looks limited and vulnerable to another leg lower. The pair will continue to be driven by the US dollar, while the euro will remain under constant pressure as the ECB wrestles with stagnating growth and rampant inflation. A hawkish outtake from chair Powell tomorrow will test the pair’s resolve and leave 1.0900 vulnerable. Below here the recent 1.0806 print guards a cluster of prior lows on either side of 1.0770.

Lessons For Becoming a Better Trader

EUR/USD Daily Price Chart – March 15, 2022

Retail trader data show 60.60% of traders are net-long with the ratio of traders long to short at 1.54 to 1. The number of traders net-long is 8.09% lower than yesterday and 9.63% lower from last week, while the number of traders net-short is 21.26% higher than yesterday and 19.71% higher from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall. Yet traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse higher despite the fact traders remain net-long.

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.