EUR/USD Price, Chart, and Analysis

The latest, hawkish, comments from Fed chair Jerome Powell suggest that the Federal Reserve is open to raising interest rates in 50 basis point clips if needed to try and counter red-hot US inflation. Chair Powell remark yesterday that if the Fed thinks that it is ‘appropriate to raise (by 50 basis points) at a meeting, or meeting, we will do so’, sent yields on US Treasuries soaring, with the interest rate sensitive UST 2 year now quoted with a yield of just under 2.19%, its highest level in three years.

US Dollar Outlook – Dancing to The Fed’s New Soundtrack

US Treasury Two Year Yield Daily Price Chart – March 22, 2022

Chart and data via @Investing.com

The single currency remains under pressure with higher energy prices boosting inflation and weighing on growth. In his latest speech, ECB Vice-President Luis de Guindos said that while inflation is expected to remain high ‘for a longer period’ he sees no stagflation as ‘even in our most adverse scenario for the current year, we still foresee growth of more than 2%’. ECB President Christine Lagarde speaks today at 13:15 GMT and her comments should be followed closely.

For all market-moving data releases and events, see the DailyFX Economic Calendar

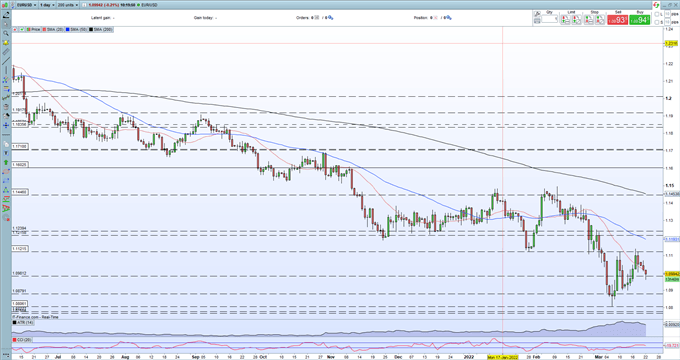

EUR/USD is trading on either side of 1.1000 with any move higher being pared back. Last Thursday’s 1.1138 high print is unlikely to come under pressure in the short term, while the recent run of higher lows has been broken convincingly. The longer-term run of lower highs and lower lows remains intact and the pair is now testing the 20-day simple moving average. If this turns indicator turns into resistance, it is likely that bears will push for 1.0900 and the recent two-year low at 1.0879.

EUR/USD Daily Price Chart – March 22, 2022

Retail trader data show 61.55% of traders are net-long with the ratio of traders long to short at 1.60 to 1. The number of traders net-long is 5.98% higher than yesterday and 2.22% lower from last week, while the number of traders net-short is 3.44% lower than yesterday and 6.06% lower from last week. The pair are now testing the 20-day simple moving average

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests EUR/USD prices may continue to fall. Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

What is your view on the EURO – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.