FTSE, DAX News and Analysis

- European indices advance as optimism around China’s lockdown reignites short-term risk appetite

- Key FTSE technical levels analyzed

- DAX symmetrical triangle threatening upside breakout

Risk Sentiment Eases Alongside China’s Lockdowns

Shanghai reported three consecutive days with no new coronavirus cases which suggests that strict lockdowns could soon be abolished or eased somewhat. Earlier this week Shanghai officials eyed the 1st of June as an appropriate time to start returning to normality however, one would imagine that the situation could change if there is a sudden uptick in new cases as China pursues a zero-Covid strategy.

It’s been a fairly rough few weeks for equities, particularly the Nasdaq and S&P500, resulting in markets welcoming the positive news which has resulted in a lift in sentiment and overall index prices. European indices march higher as the FTSE 100 and Germany’s DAX index experience a lift this morning.

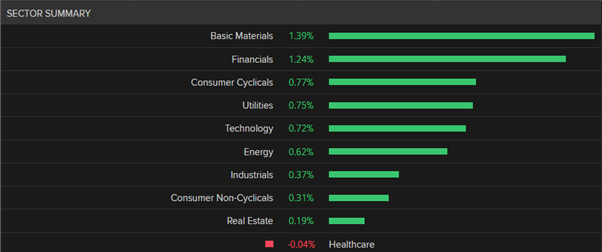

Looking at the FTSE Index, all sectors apart from the pharmaceuticals sector advanced as basic materials and financials lead the way in the London AM session. Rising inflation and optimism around China’s renewed demand for commodities supported rises in oil and metals (silver, gold and copper). Notable mentions include Imperial Brands, Fresnillo and Prudential as the biggest movers while Unilever, Ocado and Next PLC are among some of the shares trading lower this morning.

FTSE Winners vs Losers This Morning

Source: Refinitiv

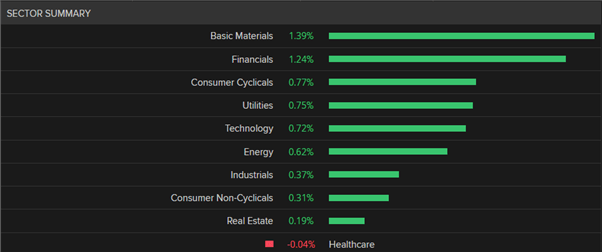

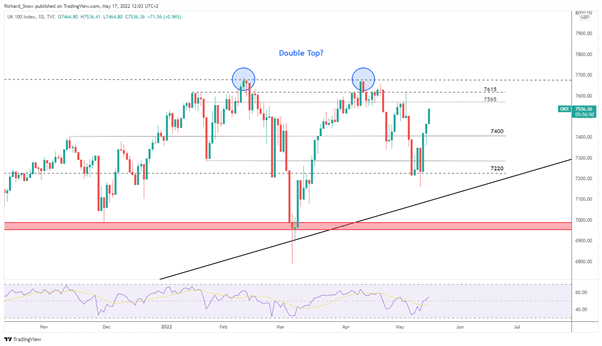

FTSE 100 Technical Analysis

The FTSE 100 index has completed a strong turnaround since rejecting the 7220 level. Energy stocks have benefitted from oil’s recent rise while mining stocks benefit from the bullish turnaround in metals prices.

7565 appears as near-term resistance followed by the prior high at 7615, before the yearly high of 7687. Support comes in at 7400 followed by 7285.

FTSE 100 Index Daily Chart

Source: TradingView, prepared by Richard Snow

In the current global macro environment of runaway inflation, aggressive rate hiking cycles and a rising dollar; equities remain in a tough spot. Despite the FTSE’s strong relative performance due to a heavy weighting in energy and mining stocks, UK equities may simply be rising to attractive levels before we witness a continued decline in line with the ‘sell the rally’ sentiment. Declining growth forecasts for the UK also pose risks to the downside after the March GDP data showed a month-on month-contraction.

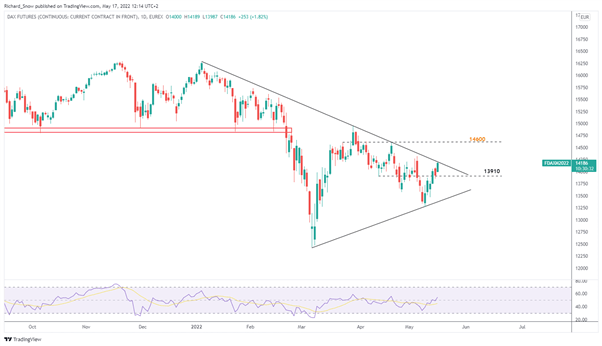

DAX Technical Analysis

The DAX reveals a very interesting symmetrical triangle pattern which appears to be shaping up for a topside breakout. To avoid a fakeout scenario, any break above the descending trendline resistance may retest the same trendline before advancing towards 14600. Support appears at 13910 which is likely to witness price action trading within the triangle in the event of a failure to breakout.

DAX Continuous Futures Daily Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX