Gold Fundamental Outlook: Neutral

- Gold is still struggling to gain further momentum

- Restrained global yields work in XAU/USD’s favor

- Risks ahead: RBA, BoC, ECB, US jobs data, Brexit

Anti-fiat gold prices will likely continue focusing on fundamental headlines that impact the US Dollar and Treasury yields. The yellow metal has been struggling to find material upside momentum after its pace of appreciation notably cooled from the middle of April. Will this change in the week ahead?

Starts in:

Live now:

Jun 03

( 00:06 GMT )

How can trader positioning impact gold?

What Do Other Traders Buy/Sell Bets Say About Price Trends?

Gold is a non-interest-bearing asset that can also benefit during periods of relatively high inflation. The coronavirus outbreak and subsequent lockdown measures have raised near term prospects of deflation as economies contract. But also, central banks around the world have taken bold measures to support growth by slashing borrowing costs and in some cases, resorting to unconventional policies like quantitative easing.

The latter are designed to help jumpstart growth and try to boost inflation down the road. It is unlikely that major central banks, such as the Fed and ECB, will raise rates in the near term. As such, depressed yields may work in gold’s favor in the medium term. It should also be noted that gold is relatively less liquid than most major fiat currencies, specifically compared to the haven-linked US Dollar.

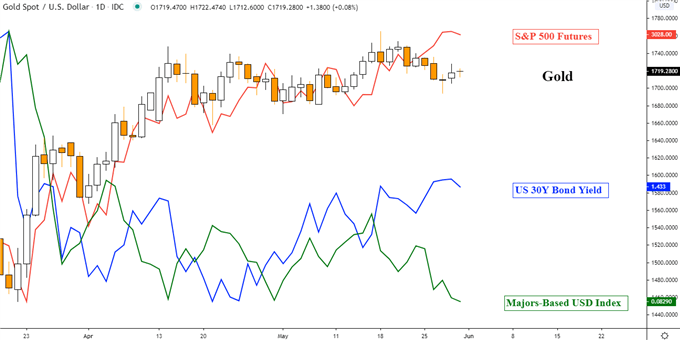

This means that an event that suddenly induces aggressive risk aversion, such as the coronavirus, may boost the Greenback as investors prioritize preserving capital. In fact, when global stock markets collapsed in February and March, gold eventually succumbed to selling pressure as the US Dollar soared. Since then, rising stock markets and a cheaper USD have likely been working in the yellow metal’s favor.

Discover your trading personality to help find forms of analyzing financial markets

Economic Event Risk – RBA, BoC, ECB, US Jobs Data, Brexit Talks

Ahead, the RBA, BoC and ECB hold monetary policy announcements. If policymakers reiterate on commitments to keeping rates around zero, then that may continue upholding gold’s appeal in the medium term. Even as nations continue easing lockdown restrictions, opening the door for a further reinvigoration in economic activity, that may not inspire monetary authorities to take away the proverbial punchbowl.

It is unclear the extent to which Friday’s US jobs report could induce risk aversion. The unemployment rate is expected to tick higher to almost 20 percent in May, the most since the Great Depression. Markets have been largely looking past lagging data in favor of lockdown easing bets. In other words, the US economy could recover rather quickly absent material risks.

These are an unknown. They may include a second wave of the coronavirus that causes states to reintroduce stay-at-home orders. Meanwhile Brexit talks seem to be lackluster ahead of the extension deadline for the transition period coming up in late June. Talks between the UK and EU resume ahead. The European Union’s Trade Commissioner, Phil Hogan, said recently that “we are not making much progress at the moment”.

In addition to rising US-China tensions, fears of a no-deal Brexit risk stoking further uncertainty over recovery prospects from Covid-19. On balance, this makes for a neutral call for this week’s gold fundamental outlook.

| Change in | Longs | Shorts | OI |

| Daily | 2% | -8% | -1% |

| Weekly | 0% | -8% | -2% |

Gold Fundamental Drivers – (Daily Chart)

Gold Chart Created in TradingView

— Written by Daniel Dubrovsky, Currency Analyst for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter