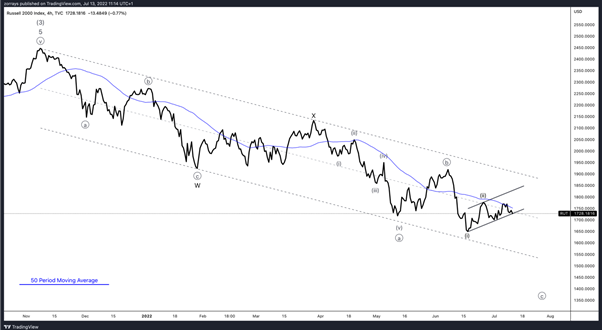

Russell 2000 Index – 4 Hour Timeframe – July 13 2022

Source: TradingView, prepared by Zorrays Junaid

Elliott Wave Breakdown

As per the 4-hour time frame above the Russell 2000 is playing within an Elliott Wave Double Correction. It formed a new low which was subwave (i) of wave ((c)) however it is correcting ever since then.

As long as price does not break the highs of wave ((b)) – a continuation to the downside is feasible considering the Russell 2000 is yet to complete this bearish cycle.

Descending Channel

The Russell 2000’s corrective cycle to the downside is also contained within the dotted parallel lines. As long as it is playing within this descending channel – the Russell 2000 would still be within it’s decline since November 2021 highs at 2446.

The Russell 2000 is currently within a bullish sequence on a lower degree. This sequence is a correction against the bearish sequence. This is also contained within a parallel channel and once price breaks through this channel including 1649 lows. Another low is in the horizon.

Moving Average

Within the temporary bullish sequence, price has stalled as it collided with the 50-period moving average. A stall is a good sign that this corrective cycle is nearly done and once price breaks through 1700 to the downside, that bullish sequence is broken. And a continuation to the downside is more feasible.

The Russell 2000 Index – 1 Hour Timeframe – July 13 2022

Source: TradingView, prepared by Zorrays Junaid

On the other side of the coin, on a lower degree, the Russell 2000 can form another high if it is below 1920 wave ((b)) high.

Another push up into wave ((c)) of (ii) around 1830 would be an area to expect rotation based on wave C equals the length of wave A according to the Elliott Wave’s Fibonacci guidelines.

Either way, the bigger remains as mentioned above regardless of how much time wave (ii) needs to correct. A downside expectation is still in play.