S&P 500, FTSE 100 Analysis and News

- S&P 500 | OPEX Offers Potential Headwinds

- FTSE 100 |Relief Rally Faces 200DMA Test

S&P 500 | OPEX Offers Potential Headwinds

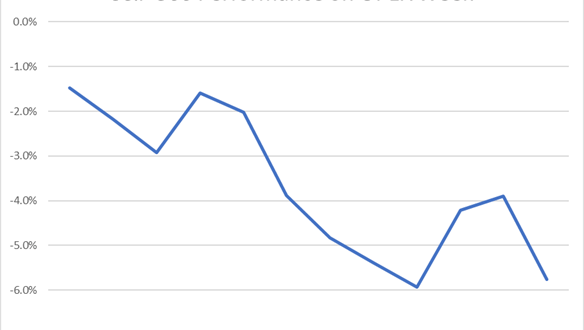

A rather choppy week, however, the recent lows remain intact and thus I remain bullish above 4100. That being said, there do still remain downside risks in the form of geopolitical tensions, which has been mentioned at length. Alongside this, next week is OPEX (option expiry) and more specifically, the quarterly quadruple witching. OpEx is an event where stock options expire on the third week of the month, which throughout 2021 had typically coincided with equities coming under pressure. As shown in the image below, the cumulative performance of the S&P 500 in the third week of each month in 2021 was -5.8% (Figure 1). Additionally, this year has also shown a similar pattern with the S&P falling 5% in January and 1.2% in February (Figure 2).

Figure 1.

Source: Refinitiv, DailyFX

Figure 2.

Source: Refinitiv

FTSE 100 |Relief Rally Faces 200DMA Test

Having held onto touted key support at 6800 earlier in the week, topside levels in the form of the 200DMA is now in focus. Given the abovementioned OpEx week and with geopolitical tensions remaining in the backdrop, prior support now resistance looks to cap the recent relief rally. Keep in mind that as we head into the weekend, prudent traders will look to lighten up exposure in order to avoid gap risk.

FTSE100 Chart: Daily Time

Source: Refinitiv

|

Price |

50DMA |

100DMA |

200DMA |

RSI |

IG Sentiment |

|

|

Europe |

||||||

|

FTSE 100 |

7176 |

7449 |

7356 |

7223 |

43 |

Bullish |

|

13625 |

15083 |

15416 |

15507 |

40 |

Mixed |

|

|

US |

||||||

|

S&P 500 |

4259 |

4487 |

4564 |

4467 |

42 |

Bearish |

RESOURCES FOR TRADERS

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.