Consumer Sentiment, US Dollar – Talking Points

- Univ. Of Michigan Sentiment Jul P: 51.1 (est 50.0; prev 50.0)

- Inflation and growth concerns continue to weigh on sentiment

- US Dollar lower as markets battle over potential 100 bps rate hike

US Consumer Sentiment rose during June, as Americans remain worried about persistent inflationary pressures. 1-year forward inflation expectations fell from 5.3% to 5.2%, while 5-10 year expectations dropped to 2.8% from 3.1% in May. This solid report may cool bets on a 100 bps rate hike in July, as it was an upside surprise in 5-10 year inflation expectations back in May that caused the Fed to raise by 75 bps instead of 50. The upside surprise on sentiment bolstered risk assets, with both the Nasdaq 100 and S&P 500 gaining more than 1% premarket. The US Dollar remained on the backfoot following the release, with EURUSD pushing further away from parity into the weekend.

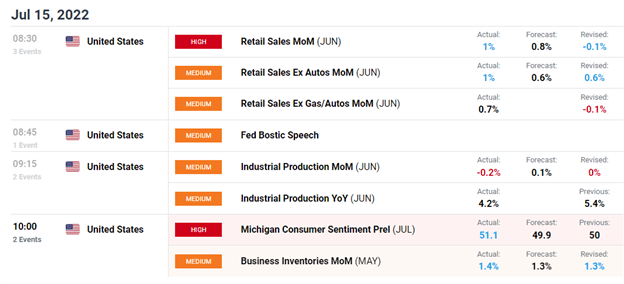

US Economic Calendar

Courtesy of the DailyFX Economic Calendar

Stay tuned, more to follow…

Resources for Forex Traders

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve trading performance, and one specifically for those who are new to forex.

— Written by Brendan Fagan

To contact Brendan, use the comments section below or @BrendanFaganFX on Twitter