US Dollar, DXY Index, USD, PCE, Treasury Yields, ECB, G-20, USD/JPY – Talking Points

- The US Dollar resumed strengthening as price pressures build

- The Fed reminded markets of their intention and yields responded

- Equities and risk assets are struggling. Will USD be boosted by sentiment?

Trade Smarter – Sign up for the DailyFX Newsletter

Receive timely and compelling market commentary from the DailyFX team

Subscribe to Newsletter

The US Dollar has held onto the gains seen going into the close last week after a red-hot core US PCE print on Friday and Fed officials re-iterating their hawkishness.

To recap, the core US PCE index came in at 4.7% year-on-year to the end of January on Friday against 4.3% anticipated and 4.6% previously. This is regarded by the markets as the Fed’s preferred measure of inflation.

Risk assets are generally under pressure to start the week as the market contemplates the Fed funds rate path. 25 basis point hikes are now priced in for their next 3 meetings and the peak in this rate cycle is now 5.4%, rather than the 4.9% anticipated last month.

Fed board members Loretta Mester, James Bullard and Susan Collins all crossed the wires with hawkish comments over the weekend.

Treasury yields have held the higher levels seen on Friday with the 2-year note surging above 4.8% again, the highest level in 15-years.

APAC equities are mostly in the red to varying degrees today to reflect the negative US equity performance on Friday. Futures are pointing to a steady start for the Wall Street cash session later.

Currency markets have mostly had a quiet day so far with the Aussie and Kiwi Dollars dipping to reflect the risk aversion sentiment.

The G-20 meeting has wrapped up with no consensus on the wording of the communique. Russia and China objected to terminology and language around the Ukraine war.

Ignazio Visco, European Central Bank (ECB) Governing Council member and Bank of Italy Governor, made comments that rates will be as restrictive as necessary to deal with the inflation problem.

The firming of crude oil prices on Friday has been maintained today with the WTI futures contract near US$ 76 bbl and the Brent contract nudging toward US$ 83 bbl. Gold appears vulnerable as it trades down toward US$ 1,800 an ounce.

Incoming Bank of Japan Governor Ueda appeared in Japan’s parliament today and said that the current monetary policy stance is appropriate for now.

The full economic calendar can be viewed here.

Recommended by Daniel McCarthy

Traits of Successful Traders

DXY (USD) INDEX TECHNICAL ANALYSIS

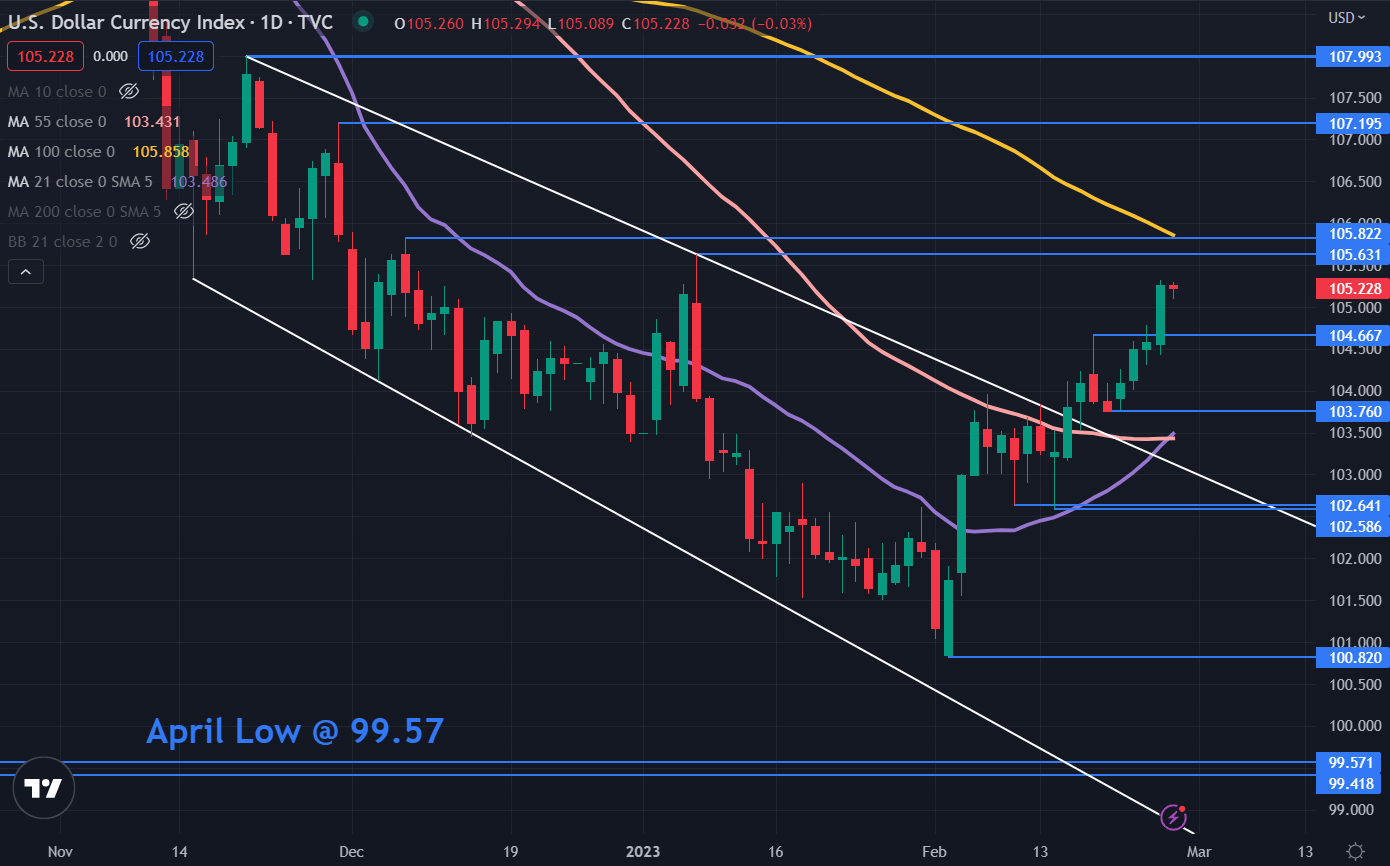

The DXY index has continued to surge higher after breaking out of a descending trend channel

The 21-day y simple moving average (SMA) has crossed above the 55-day SMA to generate a Golden Cross that may indicate that bullish momentum could evolve.

Resistance might be at the previous peaks of 105.63 and 105.82. The latter is also near the 100-day SMA which may lend resistance.

On the downside, support could be at the breakpoint of 104.67 ahead the prior lows of 103.76, 102.58 and 100.82.

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCathyFX on Twitter