US Dollar, Singapore Dollar, Thai Baht, Indonesian Rupiah, Philippine Peso, ASEAN, Fundamental Analysis – Talking Points

- US Dollar may lose some upside momentum against ASEAN currencies

- ASEAN Covid case growth slowing, softer US NFPs may weaken USD

- USD/THB eyes Bank of Thailand amid downgrade to Q3 GDP estimates

US Dollar ASEAN Weekly Recap

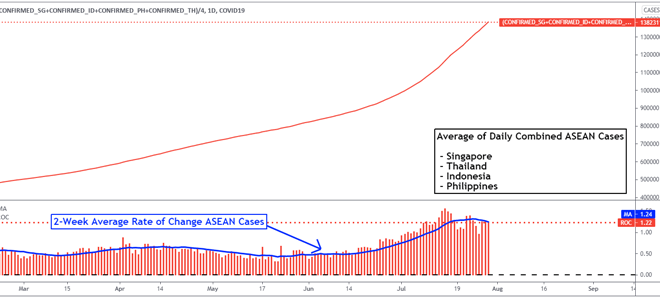

The US Dollar levelled off against some of its ASEAN counterparts this past week, either slowing or reversing lower against the Singapore Dollar, Thai Baht, Philippine Peso and Indonesian Rupiah. Emerging APAC currencies have generally been under intense selling pressure amid surging regional Covid cases due to the more contagious Delta variant. Over the past week, the rate of virus case growth in ASEAN countries has been leveling off – see chart below. Could this be a turning point for these nations and the US Dollar?

Covid Cases in Singapore, Thailand, Indonesia, Philippines – Averaged

Chart Created Using TradingView

Key ASEAN Event Risks – Slowing Covid Case Growth, US Non-Farm Payrolls

Emerging market currencies are often vulnerable to fundamental forces that can inspire capital outflows, especially if the pace is rapid. A frequent benefactor of this dynamic is the haven-linked US Dollar. That is why pairs like USD/SGD, USD/THB, USD/IDR and USD/PHP have lately been rising. Lockdowns, or the possibility of shutdown extensions, pose a risk to local growth.

In the Philippines, the government reimposed lockdowns in the capital from August 6th until August 20th. As a result, the Philippine PSEi benchmark stock index fell to its lowest since late May. Meanwhile, in Thailand the Finance Ministry cut 2021 GDP growth estimates to 1.3% from 2.3% prior amid quasi-lockdowns that the government embarked upon earlier.

Thailand tourist arrivals are now estimated to clock in at just 0.3 million, down from the 2m envisioned before. Tourism accounts for about 20% of local GDP, hence the material downgrade to economic growth. USD/THB has been surging lately, but gains have slowed cautiously as the pair hovered just under 2020 highs. In Indonesia, the government extended mobility restrictions this past week.

On the bright side, Singapore’s prime minister anticipated that the city-state’s ‘heightened alert’ should be removed later in August. Altogether, if these policies help curb the spread of the disease, the light at the end of the tunnel could near. That may offer a turning point for ASEAN currencies as these countries continue making progress towards vaccinating their populations.

Some relief may be found from the United States in the week ahead. Economists now seem to be overestimating the health and vigor of the world’s largest economy. If that opens the door to a softer-than-expected non-farm payrolls report on Friday, that could further cool Fed tapering expectations. That is something that SGD, IDR, THB and PHP may end up benefiting from.

ASEAN, South Asia Economic Data – Bank of Thailand

Focusing on ASEAN economic event risk, the Bank of Thailand monetary policy decision is due on Wednesday for USD/THB. Benchmark lending rates are likely to be left unchanged at 0.5%. Given prospects of a recession in the third quarter, the central bank may leave a dovish stance. This is especially amid inflation that has been trending lower. On Thursday, Thailand CPI is expected at 0.93% y/y in July from 1.25% prior. That may keep USD/THB tilted to the upside. Philippine and Indonesian inflation data will also cross the wires this week, likely revealing a similar trend of slowing CPI for USD/PHP and USD/IDR respectively.

Check out the DailyFX Economic Calendar for ASEAN and global data updates!

On July 30th, the 20-day rolling correlation coefficient between my ASEAN-based US Dollar index and my ASEAN ETF index remained changed at -0.85 from -0.96 one week ago. Values closer to –1 indicate an increasingly inverse relationship, though it is important to recognize that correlation does not imply causation.

ASEAN-Based USD Index Versus ASEAN ETF Index – Daily Chart

Chart Created Using TradingView

*ASEAN-Based US Dollar Index averages USD/SGD, USD/IDR, USD/THB and USD/PHP

— Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter