US Dollar, Singapore Dollar, Thai Baht, Indonesian Rupiah, Philippine Peso, ASEAN, Fundamental Analysis – Talking Points

- US Dollar gained against most ASEAN currencies last week

- Less-dovish Fed bets, slowing Chinese growth bets in focus

- Will US-China trade tensions resurface? Eyes on the RBI

US Dollar ASEAN Weekly Recap

The US Dollar gained against its ASEAN counterparts this past week, including the Singapore Dollar, Thai Baht, Philippine Peso and Indonesian Rupiah. Some of these Emerging Asia-Pacific currencies can bet quite vulnerable to market sentiment, which notably deteriorated this past week. In fact, a quick look at the 20-day Simple Moving Average tracking the VIX shows that market volatility has been in a gradual uptrend as of late.

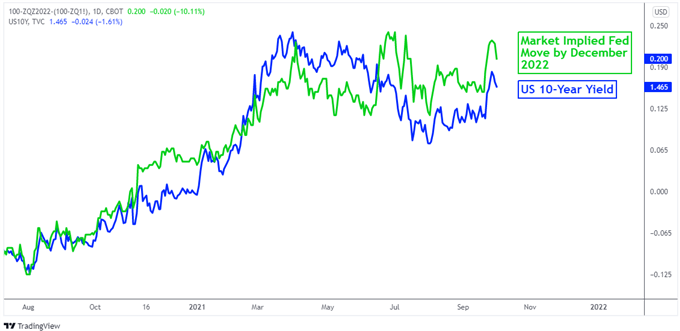

A key cause of these market jitters could be coming from US monetary policy expectations. The 10-year Treasury yield has been aiming higher recently, albeit the bond rate declined slightly into the end of the week. Ever since Fed Chair Jerome Powell hinted that the central bank may finish tapering by the middle of next year, markets have been increasing bets of a 25 basis point rate hike by the end of 2022.

Covid Cases in Singapore, Thailand, Indonesia, Philippines – Averaged

Chart Created Using TradingView

External ASEAN Event Risk – Fed Policy Bets, NFPs and US-China Trade Tensions

With that in mind, ASEAN currencies may remain vulnerable to fundamental forces emanating from outside of the developing Emerging Asia region. The latest US core PCE report for August clocked in higher-than-expected across the board on Friday. This could further solidify less-dovish Fed bets given that the PCE gauge is the central bank’s preferred measure of inflation.

On Friday, all eyes turn to the US non-farm payrolls report. As a reminder, the August headline print disappointed expectations at 235k. Economists are anticipating a gain of 470k positions in September. Still, it should be noted that last month’s jobs report saw the unemployment rate decline as hourly earnings came in hotter-than-expected. In September, the latter is expected to clock in at 4.6% y/y from 4.3% prior.

Similarly strong wage data could further bring forward hawkish Fed policy bets, pushing up Treasury rates, threatening Emerging Market sentiment. That is because over the past decade, many developing economies accumulated USD-denominated debt. When US interest rates are expected to rise, all else being equal, servicing these debts becomes increasingly harder. An appreciating US Dollar could further compound this challenge.

A notable developing story to watch is US-China trade tensions. On Friday, US Trade Representative Katherine Tai announced that she will declare that China is not in compliance with the phase one trade deal. That is the agreement that the previous administration established with their Chinese counterparts. At this time, the USTR is evaluating actions over China’s non-compliance. Remerging fears of US-China tensions risk further deteriorating sentiment.

Check out the DailyFX Economic Calendar for ASEAN and global data updates!

ASEAN, South Asia Economic Data – RBI Rate Decision, Singapore Retail Sales, Philippine CPI

There are a couple of economic events that may result in ASEAN FX volatility. Fears of a slowing China still linger. Official manufacturing PMI data for September printed 49.6 versus an anticipated 50. Outcomes under the latter indicate a contraction in activity. While the Chinese economic docket is light this week, traders ought to keep an eye out for news relating to Evergrande.

While contagion risks are seemingly being ruled out by central bankers from developed economies, the aftermath of a potential default could hurt the local economy. This is as the nation is also contending with energy issues, forcing the country to reconsider a ban on Australian coal imports. Considering these issues, key trading relationships between ASEAN countries and China could have lasting impacts on SGD, THB, IDR and PHP.

This could be perhaps why the Singapore Dollar may look past local data such as retail sales and GDP in the coming week. PHP may also brush aside CPI data for external risks. Outside of the ASEAN countries, the Indian Rupee will be closely eyeing October’s RBI rate decision. Monetary policy is anticipated to stay lose with recent easing CPI data. Still traders will likely be watching for hints of how soon a rate hike could occur next year.

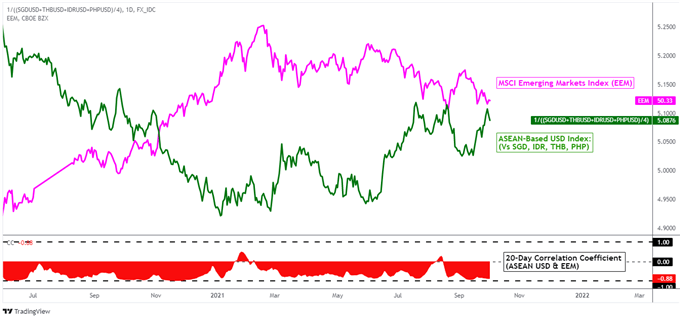

On October 1st, the 20-day rolling correlation coefficient between my ASEAN-based US Dollar index and the MSCI Emerging Markets Index changed to -0.88 from -0.85 one week ago. Values closer to –1 indicate an increasingly inverse relationship, though it is important to recognize that correlation does not imply causation.

ASEAN-Based USD Index Versus EEM Index – Daily Chart

Chart Created Using TradingView

*ASEAN-Based US Dollar Index averages USD/SGD, USD/IDR, USD/THB and USD/PHP

— Written by Daniel Dubrovsky, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @ddubrovskyFX on Twitter