US Dollar Talking Points

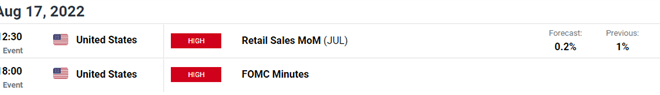

The US Dollar Index (DXY) bounces back from a fresh monthly low (104.64) as it attempts to retrace the decline following the slowdown in the US Consumer Price Index (CPI), but the Federal Open Market Committee (FOMC) Minutes may drag on Greenback should the central bank show a greater willingness to implement smaller rate hikes.

Technical Forecast for US Dollar: Neutral

DXY fails to defend the opening range for August as indications of slowing price growth curb bets for another 75bp Fed rate hike, and the index may continue to trade to fresh monthly lows if the FOMC Minutes point to a change in the central bank’s approach in combating inflation.

The statement may show a growing discussion to winddown the hiking-cycle after pushing the Federal Funds rate to neutral, and the central bank may deliver smaller rate hikes over the coming months as Chairman Jerome Powell acknowledges that “it likely will become appropriate to slow the pace of increases while we assess how our cumulative policy adjustments are affecting the economy and inflation.”

In turn, the US Dollar may face additional headwinds over the coming days if the FOMC Minutes foreshadow a change in the forward guidance for monetary policy, but more of the same from the central bank may lead to a larger rebound in the Greenback as Chairman Powell insists that “another unusually large increase could be appropriate at our next meeting.”

With that said, the FOMC Minutes may influence the near-term outlook for the US Dollar as signs of slowing inflation cast doubts for another 75bp rate hike, and little hints of a looming shift in Fed policy may prop up the Greenback as the central bank carries out a restrictive policy.

— Written by David Song, Currency Strategist

Follow me on Twitter at @DavidJSong